If you are thinking about investing in an EB-5 project, you need to review the project’s key financial statements. Not doing so is reckless.

Imagine you are planning a long car trip through a desert that has no gas stations or other services. You wouldn’t start driving without first checking how much gas you have, right?

It is the same with investing. Checking financial statements helps you understand the financial situation of a project right before you invest. This information is key to making a smart decision.

Financial statements are like your car’s fuel gauge. Before you invest, you need to check this gauge to avoid taking an unnecessary risk.

In this article, we offer a short explanation of why most EB-5 regional centers do not share financial statements. We then provide some basic information on financial statements, why they matter, and what they can show you. We also list the main financial questions you need to ask before investing in any EB-5 project.

Why Don’t Most EB-5 Regional Centers Share Financial Statements?

What Are Financial Statements and Why Do They Matter?

How to Read and Review Financial Statements

Make Sure You Understand a Project’s Financial Statements before Investing

Regional Centers Should Provide Financial Statements upon Request

Why Don’t Most EB-5 Regional Centers Share Financial Statements?

The standard practice for investors is to check financial statements before investing. Real estate investors will not invest without first seeing the company’s balance sheet and income statements. In the same way, banks won’t loan funds to a developer without reviewing these key documents.

Developers usually make these financial statements available to investors. That is the norm.

But almost none of the EB-5 projects in the market share these financial statements with potential investors.

Why not?

First, sharing financial statements is not required by USCIS, nor is it required under U.S. securities laws for private offerings.

Second, many EB-5 investors are not experienced investors, and so do not know to ask for them.

Third, EB-5 project sponsors choose not to share them. Let’s explore this point in more detail.

If sharing financial statements with potential investors is normal, why would an EB-5 regional center choose not to share them?

The most common reasons are as follows:

1. The EB-5 project that the regional center is promoting is brand new. It has no track record or evidence of feasibility. Historical financial statements for the EB-5 project company or “job creating entity” simply do not exist.

2. EB-5 funds being loaned to the project company are not secured by a repayment guaranty from a separate company. As a result, the financial statements of a guarantor company do not exist.

3. The financial statements that do exist for the EB-5 project company look “bad.” Very likely, the project company’s balance sheet shows little to no equity. It may reveal major liabilities. The income statements likely show little to no revenue. They might also show substantial losses. Because of these issues, the EB-5 regional center does not actively share these documents with potential EB-5 investors. It is afraid of scaring off these potential EB-5 investors.

The regional center may feel that withholding financial statements is acceptable because sharing them is not required under U.S. law.

No matter the reason, not sharing these financial statements is wrong. EB-5 investors are being asked to put their money—in many cases their life’s savings—into a project without knowing all of the financial details. Our hope is that because of this post, all prospective EB-5 investors will insist on seeing financial statements before investing in an EB-5 project.

If an EB-5 regional center refuses to give potential investors’ the relevant financial statements, that is a serious red flag. EB5AN is happy to share the financial statements for all of our EB-5 projects with prospective EB-5 investors.

We also hope that this post will encourage other major regional centers to share the financial statements for their EB-5 projects. Doing so will increase transparency in the EB-5 industry and help EB-5 investors make better, more informed investment decisions.

What Are Financial Statements and Why Do They Matter?

Project details like location, size, and type will vary from one project to another. This can make it hard for investors to compare projects. But financial statements serve as a standard for measuring projects against each other.

Investors usually look at three main financial statements to understand a company’s financial health: the balance sheet, the income statement, and the cash flow statement. Each of these documents offers different insights into the company’s financial status and performance.

In the context of EB-5 investments, all three financial statements are useful. The balance sheet and income statements are vitally important. Less critical is the cash flow statement, which shows where a company’s money comes from and where it goes.

The EB-5 program is focused on the creation of jobs. This goal is more directly tied to what the company owns (balance sheet) and how much money it makes (income statement). Also, if a project is successful and makes money (income statement), it can repay EB-5 investment funds.

For these reasons, this post will focus on the balance sheet and the income statement. These two types of financial statements show how financially healthy, stable, and profitable a company is. These are essential factors that contribute to the success of an EB-5 project and the timely repayment of EB-5 investment funds.

How to Read and Review Financial Statements

Following is a more detailed look at these types of financial statements and some basic guidance on how to review them.

Balance Sheet

The balance sheet shows the company’s assets and liabilities at a specific point in time. It provides a snapshot of what the company owns (assets) minus what it owes (liabilities), which is what it has left for shareholders (equity).

Assets: A balance sheet starts by listing assets. Assets are what the company owns. They include liquid assets (like cash and cash equivalents) and non-liquid assets (like property, plant, and equipment). In the case of real estate, property and real estate inventories are the most important assets.

Liabilities: The second major section on a balance sheet is liabilities. These are all of the company’s debts and the payments it needs to make. In real estate, this usually includes mortgages and other loans as well as accounts payable and accrued expenses. The total amount of liabilities compared to the total assets will give you a sense of how leveraged the company is at the time.

Equity: This is the value that is left when you subtract a company’s liabilities from its assets. The equity section will show the effective “net worth” of a company to its shareholders or members.

For EB-5 investors, the financial health of the project company—or “job creating entity” —is of primary importance. Of equal importance is the financial health of any separate company guarantying to repay your EB-5 investment. The amount of equity will indicate how safe or how risky a project is. The larger the amount of equity, the better for EB-5 investors.

Key Question: How much equity does the project company and guarantor have?

Best Answer: The project company has significant equity in the project. The project has a repayment guaranty from a separate, diversified company. This company has substantial assets and net equity that far exceed the amount of the EB-5 loan.

Worst Answer: The project company has minimal equity and is highly leveraged. The project does not have a repayment guaranty.

Income Statement

The income statement lists the company’s revenues and expenses. Ultimately, this reveals its net income. It shows how much money the company has made (revenues), how much it has spent (expenses), and what is left over (net operating profit or loss) at the end of a certain period.

Revenues: These are the amounts earned by the company through its activities. Usually, for property development projects, this is money earned from the sale of residential units.

Expenses: These are the costs the company incurs to generate revenues. Common expenses for a real estate development company include marketing, real estate taxes, financing costs, and administrative costs.

Net Operating Profit or Loss: This is the amount of money the company makes during a specific period minus its costs. Income will go up and down over a project’s lifecycle. For example, during the first several years of a development project, revenues are low and upfront costs are high. Then, residential units are completed and can be sold to buyers, which creates sales revenues.

For EB-5 investors, income statements are important in two main ways. First, job creation is often measured by how much money is spent. If an income statement shows no spending, that means the project is not creating jobs. Second, project success depends on revenues. If a project is just getting started, revenues may not yet exist—and that may be normal. If a project is later in its development and no revenues exist, this may be a sign of trouble.

Key Question: How much money is the project spending and how much is it earning?

Best Answer: The company is spending money, but its income exceeds its costs. The project is already profitable.

Worst Answer: The company has little spending and no revenues, or, late in project development, the company’s spending still far exceeds its revenues.

Make Sure You Understand a Project’s Financial Statements before Investing

Do not invest without getting a good understanding of the financial status of a project. Just like checking the fuel gauge in your car before a long drive, you need to know the project is financially sound before you trust it with your money.

If you are reviewing a project’s financial statements, take all the time you need to understand what they mean. If you are having trouble knowing whether the project is financially healthy, hire someone to help you. Find an accountant or investment adviser that is independent from the project company and get their opinion of the project.

Regional Centers Should Provide Financial Statements upon Request

To get a clear picture of a company’s financial health, you need access to its financial statements.

If you are interested in an EB-5 project and request information but the regional center does not share any financial statements, you should ask for them. If they refuse to provide them, avoid this project. You should not invest in a project if you do not know the financial condition of the EB-5 project company and any other company separately guarantying the repayment of EB-5 funds.

The balance sheets of the project company and, if applicable, of the loan’s guarantor are, by far, the most important financial statements for EB-5 investors. These documents are key to assessing how likely a company is to finish its project and repay the EB-5 loan.

While less important than a company’s balance sheet, its income statements will offer valuable insights into the merits of the project.

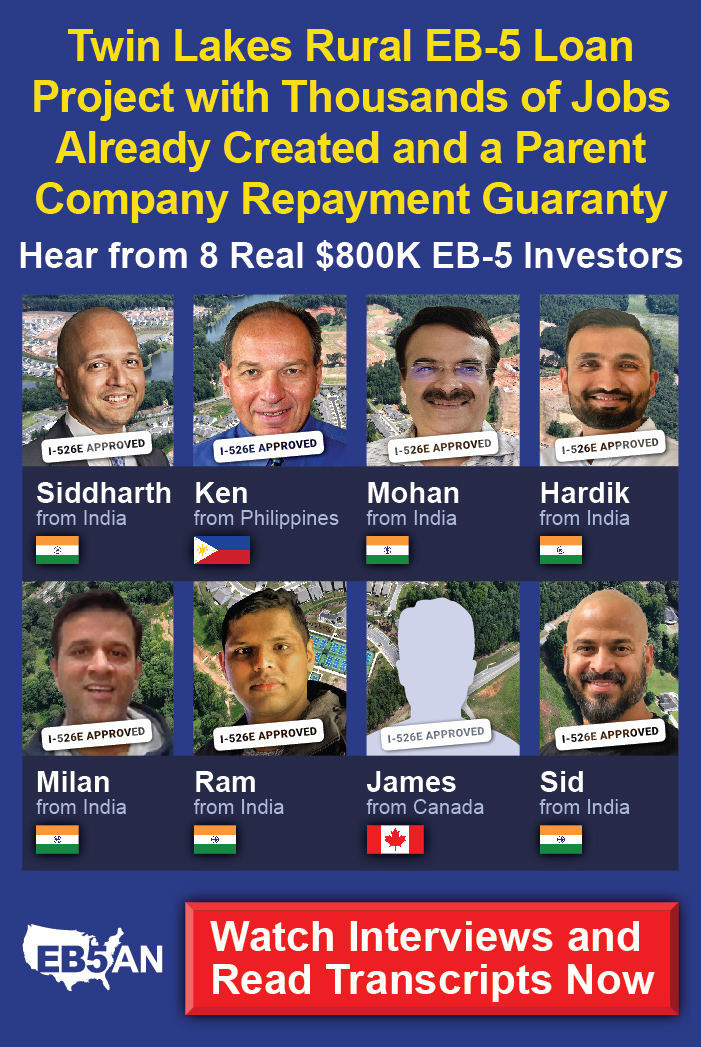

At EB5AN, we are committed to providing EB-5 investors all of the information they need to make a good decision. If you are interested in one of our best-in-class, low-risk projects, reach out. We will gladly share our projects’ financial statements.

If you have any questions or would like more information about our projects, please schedule a free call.