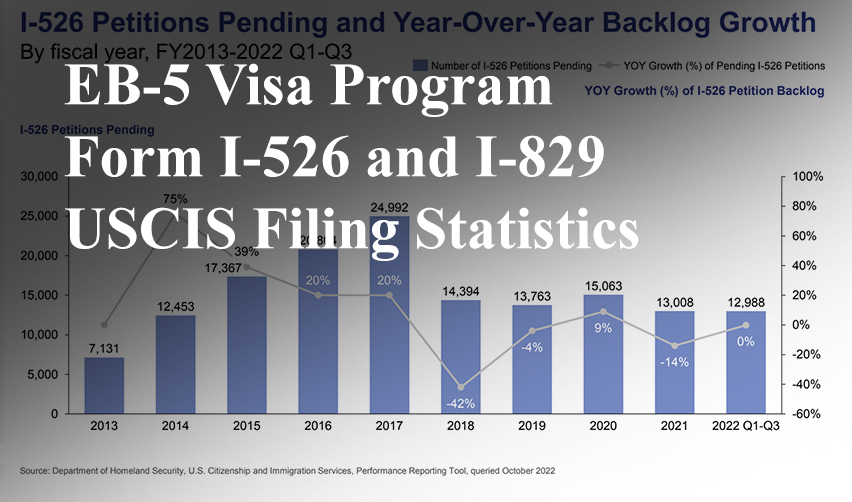

United States Citizenship and Immigration Services (USCIS) has now released EB-5 program processing data through FY2022 Q3 (April 2022–June 2022). This data highlights EB-5 petition processing for Forms I-526 and I-829 following several disruptions to worldwide immigration, generally, and to the EB-5 program, specifically.

Following are the primary disruptions to the EB-5 program:

- The COVID-19 pandemic severely affected immigration around the world.

- On June 22, 2021, a federal court overturned the November 2019 increase to the EB-5 investment amount, which had increased targeted employment area (“TEA”) investments from $500,000 to $900,000.

- The EB-5 regional center program lapsed on June 30, 2021, and regional center projects were unable to take on EB-5 investment from that time until the reauthorization of the EB-5 regional center program on March 15, 2022.

- The EB-5 Reform and Integrity Act of 2022 (the “RIA”) was passed on March 15, 2022, reauthorizing the EB-5 regional center program and implementing a host of changes to the EB-5 program more broadly.

Download EB5AN’s analysis slides for a comprehensive breakdown of the FY2022 Q3 data, and continue reading for detailed analysis and key takeaways.

Data from I-526 Petitions

Data from I-829 Petitions

Forms I-526 and I-829 Processing Data Comparison

Key Takeaways from New Petition Processing Data

Data from I-526 Petitions

For Form I-526, the new data shows that Q3 saw a significant rise in adjudications and a steep decline in receipts when compared to the previous two quarters.

Receipts

Since FY2020 Q2, I-526 petition receipts have remained historically low. Receipts increased noticeably from FY2021 Q4 to FY2022 Q2, but dropped to a near-record low in FY2022 Q3.

Increased Receipts from FY2021 Q4 to FY2022 Q2

A spike in I-526 petitions from FY2021 Q4 to FY2022 Q2 is likely the result of legal action that reset the minimum amount for investments in TEAs back to $500,000 from $900,000. Even with the regional center program paused during this time, the option to invest $500,000 likely caused increased activity during these three quarters.

Minimal Receipts during FY2022 Q3

The decline in I-526 petition receipts in FY2022 Q3 can likely be attributed to the passage of the RIA in March 2022. The RIA changed the EB-5 program in several ways, and USCIS has yet to provide any real guidance on these changes. The changes and subsequent lack of guidance has resulted in uncertainty in the EB-5 industry, which has, in turn, resulted in fewer new immigrant petitions.

The RIA also increased the minimum investment amount from $500,000 to $800,000. The increased investment amount may have affected I-526 petition receipts as well.

Additionally, while the regional center program was reauthorized on March 15, 2022, the implementation of the RIA has required regional centers to reapply for designation prior to accepting new investments. The first regional center to receive designation under the RIA was approved in October 2022. Lack of access to regional center investments and a high degree of uncertainty during these months also contributed to low I-526 petition receipts.

Denials and Approvals

While Form I-526 denial rates remain high, they appear to be returning to historic levels following a trend of extremely high denial rates starting in FY2021 Q4.

Overall, the number of I-526 petitions being processed appears to be trending up from record low adjudications in FY2022 Q1. The number of petitions processed in FY2022 Q3 is trending closer to the average observed since FY2019 Q2, but remains low.

I-526 Petition Summary

Although overall receipts have been low since FY2020 Q2, little progress has been made to reduce the overall number of pending I-526 petitions in FY2022. A total of 641 I-526 petitions have been received in FY2022, while 668 I-526 petitions have been adjudicated during that period. The net reduction to pending I-526 petitions represents a year-to-date change of -0.15% to the number of I-526 petitions still pending adjudication.

COVID-19 policies and the lapse of the EB-5 regional center program are likely to blame for the lack of progress adjudicating I-526 petitions these past several quarters, despite a steep decline in receipts.

Data from I-829 Petitions

For Form I-829, FY2022 Q3 saw no real change in adjudication rates and a continued decline in petition receipts.

Receipts

The number of I-829 petition receipts has been declining from a peak of 1,249 in FY2021 Q3 to only 200 in FY2022 Q3. This significantly smaller number of I-829 receipts may reflect the decline in I-526 petitions starting in FY2020 Q2 as the COVID-19 pandemic began. The subsequent lull in I-526 petition filings suggests this trend of lower-than-normal I-829 receipts will persist for the foreseeable future.

Denials and Approvals

The rate of I-829 petition denials remained relatively stable in FY2022 Q3, rising only slightly from the previous quarter. The total number of adjudications is down 13% for FY2022 Q3, with approvals down 14% and denials down 4%. Overall in FY2022, Form I-829 approval and denial growth have been negative, declining 49% and 40%, respectively. These year-to-date negative growth figures are expected to improve slightly once FY2022 Q4 data is available.

I-829 Petition Summary

Despite fewer I-829 receipts, USCIS has failed to reduce the number of pending I-829 petitions. The current queue of petitions awaiting adjudication has reached an all-time high of 11,523. Unless adjudication rates drastically improve, a reversal of this trend in FY2022 Q4 is unlikely.

Forms I-526 and I-829 Processing Data Comparison

During the first two quarters of FY2022, USCIS processed substantially more I-829 petitions than I-526 petitions. For Q3, they were able to improve the number of I-526 petitions processed without sacrificing the number of I-829 petitions processed.

While petition receipts have remained relatively low for Form I-526 since FY2020 Q2, the number of receipts for I-829 petitions has been declining over the past five quarters.

For both I-526 and I-829 petitions, the number of processed petitions pales in comparison to the number of pending petitions.

Key Takeaways from New Petition Processing Data

FY2022 Q3 data shows the continued impacts of the COVID-19 pandemic, the lapse of the regional center program, and the reauthorization of the regional center program under the RIA. Form I-526 petition receipts have remained at historic lows. The effect of sustained low I-526 petition receipts is becoming obvious in a declining number of I-829 petition receipts.

Processing rates for I-526 petitions remains low but appears to be trending upward in FY2022 Q3, which may be a reflection of less restrictive COVID-19 policies and an end to disruptions in the EB-5 program. If true, Q4 may see increased petition processing.

FY2022 Q4 data will provide a clearer picture of how passage of the RIA has affected petition receipts and processing. The number of receipts will likely increase as regional centers begin accepting investors under the RIA. Changes to processing volume, however, cannot easily be predicted.