In 2008, the demand for EB-5 visas experienced a surge as the EB-5 Immigrant Investor Program became a popular way for investors to relocate to the United States.

While the investor visa program has attracted tens of thousands of investors worldwide, several retroactive rule changes and processing inefficiency at United States Citizenship and Immigration Services (USCIS) have discouraged some prospective investors from making an EB5 foreign investment.

Still, the program has overcome these challenges and remains both a popular immigration option and a valuable source of funding for the U.S. economy.

The EB-5 Program Triggers Lawsuits

Political Challenges

EB-5 Investment Fraud and Security Risks

Slow Petition Adjudication

Inefficient Data Collection

The Solution

The Road Ahead

The EB-5 Program Triggers Lawsuits

Policies and regulations concerning the EB-5 program have long been contentious and have triggered many lawsuits.

One notable case is Zhang v. USCIS, in which the court rejected USCIS’s claim that unsecured loans do not count as EB-5 investment capital.

The controversies don’t stop there; in June 2021, the EB-5 Modernization Rule was overturned in Behring Regional Center LLC v. Chad Wolf et al., thereby reversing the increase in required EB5 investment amounts. Ultimately, this decision proved beneficial to EB-5 investors.

Political Challenges

The EB-5 program occasionally faces political opposition as well. In fact, a group of senators has urged the suspension of the EB-5 program, alleging rampant fraud.

This sentiment is shared by many members of the U.S. public, largely due to biased media reports. Major news outlets frequently report on fraudulent EB-5 projects while ignoring the vast majority of honest EB-5 enterprises.

The EB-5 program is full of regulatory challenges, making the reform process quite difficult for U.S. politicians to enact.

Throughout the first half of 2021, the debate around changes to the EB-5 program was particularly contentious because the EB-5 Regional Center Program needed to be reauthorized before June 30. Unfortunately, Congress failed to pass appropriate measures before the program expired, inconveniencing EB-5 investment stakeholders from around the globe. Regional centers were ultimately unable to resume operations until mid-2022.

EB-5 Investment Fraud and Security Risks

Although the vast majority of EB-5 investors make their investments in good faith and lawfully obtain U.S. permanent residency, there may also be unscrupulous individuals among them. These few incidents often get blown up by the media, thereby hurting public opinion of the EB-5 program and motivating constant calls for reform.

EB-5 investment fraud can exist in many forms, including unlawful investment capital sources.

Although USCIS does require proof of lawful EB5 investment capital sources, poorly documented foreign records from decades ago could be used for fraud. Additionally, EB-5 investors could become the victims of fraudulent regional centers that pretend to have USCIS approval.

The EB-5 program is also subject to national security risks—several U.S. congressmen have suggested that issuing EB-5 visas can leave the United States vulnerable to spies.

This problem is further compounded by the fact that USCIS may flag EB-5 investors as possible security concerns during the review process but may not deny their visas based solely on their association with foreign adversaries.

To address these concerns, USCIS has been collaborating closely with other federal agencies such as the Federal Bureau of Investigation (FBI) and Immigration and Customs Enforcement (ICE) to detect fraudulent activities.

Fortunately, the EB-5 Reform and Integrity Act (RIA) of 2022 has introduced stricter oversight for both EB-5 investors and regional center operators.

Slow Petition Adjudication

Ever since the demand for EB-5 visas surged in 2008, investors—particularly Chinese foreign nationals—have grown especially frustrated at the delayed processing times caused by country-based limits on EB-5 visa allocation.

In 2018, USCIS hired several new employees assigned solely to work on EB-5 investment adjudication and thus sped up the processing times.

Nonetheless, the situation worsened in 2019 because USCIS implemented stronger security evaluation measures.

The following year, USCIS announced that it would prioritize I-526 petitions from countries without a backlog to streamline the process for investors from such countries. Unfortunately, this strategy was implemented around the same time the COVID-19 pandemic hit, so it did not increase processing efficiency significantly.

Once more, the RIA has introduced an innovative solution to this issue. Through the new set-aside visa categories, all EB-5 investors—including those from countries with insufficient visa supply, such as China and India—can now enjoy reasonable wait times before obtaining their Green Cards.

Inefficient Data Collection

Another administrative challenge that USCIS faces is its historically inefficient collection and storage of application data. USCIS has also failed to request sufficient information from EB-5 investment applicants. This creates a lack of information and makes it more difficult to detect irregularities.

Historically, USCIS has not been rigorous enough with EB-5 site visits, thereby opening the window for fraud. After the agency expanded its in-person site visits in 2017, the results were not surprising—more than 30% of the EB-5 projects were not operating as expected. Many had gone out of business or were deserted.

Still, this promises to change with the RIA, since USCIS is now mandated to carry out more rigorous due diligence on EB-5 projects, including more frequent audits and site visits.

The Solution

On March 15th, 2022, Congress passed the EB-5 Reform and Integrity Act of 2022. As mentioned, this bill is a bold step towards combating EB 5 visa fraud and protecting EB-5 investor funds in the Immigrant Investor Program.

One of the most significant actions undertaken by the bill is the restarting of the EB-5 Regional Center Program. The bill also grandfathers in all foreign investors who file their regional center I-526 petitions prior to September 30th, 2026.

United States Citizenship and Immigration Services has also divided Form I-526 into two forms, to speed up Immigration Services processing:

- Form I-526, Immigrant Application for a Standalone Investor

- This petition is for “direct” EB-5 investors, whose investor funds go directly into the new commercial enterprise.

- Form I-526E, Immigrant Application for a Regional Center Investor

- This petition is for “indirect” EB-5 investors, foreign investors whose investor funds go through a USCIS-approved EB-5 regional center.

The EB-5 Reform and Integrity Act also allows for concurrent filing of Forms I-526/I-526E and Form I-485, Application to Register Permanent Residence or Adjust Status.

This welcome change will speed Immigration Services processing for foreign investors already legally residing in the United States. This provision typically applies to those who are living, studying, and/or working under an H-1B, E-2, or F-1 visa.

The Road Ahead

Further changes will be needed to keep the EB-5 Immigrant Investor Program running smoothly, and to make strides against the increasing visa backlog from certain countries like mainland China.

Switching to digital filing instead of paper would allow the Immigration Services to better investigate investor fraud and regional center compliance, with greater access to foreign investors’ financial, personal, and business records, and more secure digital confirmation of the documents’ validity.

Investment fraud has been a growing concern across many sectors of the U.S. economy and government, not just the Immigrant Investor Program. Citizenship and Immigration Services and Homeland Security investigations into visa fraud are echoed by investor fraud investigations across the entire economy by the Securities and Exchange Commission.

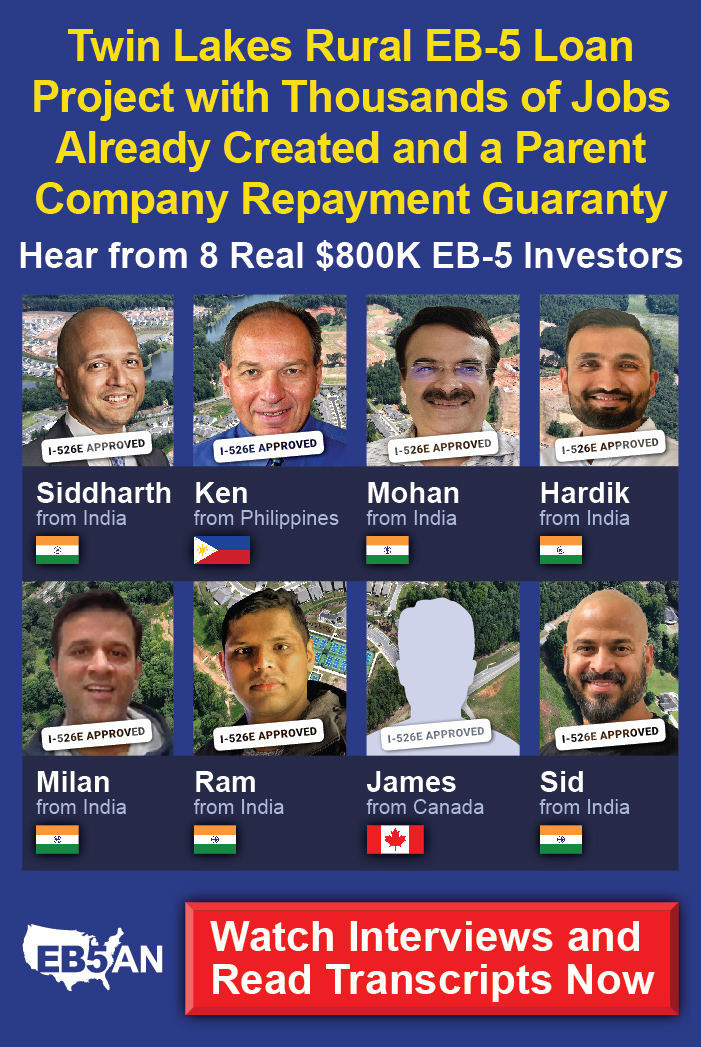

EB5AN is uniquely positioned to help investors navigate the changes to the EB-5 Immigrant Investor Program, and help them find transparent, reliable project developers and regional center operators that comply with Securities and Exchange Commission regulations and are free of Homeland Security investigations.

With a nationwide network of USCIS-reapproved regional centers operating in more than 20 U.S. states and territories, EB5AN has a sterling record of successfully guiding investors toward the safest and most legal EB-5 investments possible.

EB5AN can teach investors how you, your spouse, and your unmarried children under 21 can all receive U.S. green cards for permanent residence in exchange for making one qualifying EB-5 investment.

Schedule a free consultation to start your EB-5 visa journey.