Recently, the United States Citizenship and Immigration Services (USCIS) amended the regulations for the EB-5 investor program, creating what is possibly the most dramatic changes the program has ever seen since its creation in 1990. Most drastic are the changes to the required investment amounts. Whereas previously, investors were required to provide $500,000 for investments in a targeted employment area (TEA) and $1,000,000 for projects outside of TEAs, EB-5 investors must now cough up $900,000 for TEA projects and $1.8 million for non-TEA projects.

The second major change the USCIS has implemented is a tightening of the requirements for an area to be designated as a TEA. Under the previous system, issues of gerrymandering limited the effectiveness of TEA designations in accomplishing their intended purpose: direct investment to in-need areas. States no longer possess the authority to determine TEA designations—the job has gone to the Department of Homeland Security (DHS), which makes designations based on fairer and more consistent guidelines. In effect, this has reduced the number of areas that qualify as TEAs.

Increased Funds Mean Fewer Investors

One of the most obvious consequences of these new regulations is a reduced number of EB-5 investors, given the higher financial threshold. Not only have the required investment amounts both risen by 80%, but the new TEA restrictions also mean that the majority of geographical locations now require an investment of $1.8 million. Numerous areas that previously demanded investments of only $500,000 have more than tripled in the amount of money necessary to invest in the EB-5 program.

It goes without saying that the need to gather potentially $1.3 million more in funds renders the program unviable for many investors. Proving the legal source of these funds is more difficult and results in more work for attorneys, given the 80% to 260% higher amounts. Consequently, this results in higher processing times and higher attorney legal fees for investors.

Finally, currency export controls are more difficult to overcome with the increased fund amount. For example, investors in China—one of the top countries from which EB-5 investors hail—are required to involve a certain number of family members and friends when exporting currency. The number increases with the amount, and $1.8 may demand an unfeasibly high number for some.

Fewer Regional Centers

The number of investors is not the only metric decreasing in light of these new USCIS regulations—regional centers are also being terminated in record numbers. In 2019, 75 centers were terminated, compared to only six being approved, representing the single largest net deficit in the history of the EB-5 program. With reduced numbers of investors and fewer TEAs, regional centers are having a harder time attracting investments, and their failure to promote economic growth in their region may be grounds for their termination.

The Benefits of Reputable EB-5 Regional Centers

The regional center terminations bring along a sense of increased risk for investors because if a regional center is terminated, the associated EB-5 petitions of investors who have yet to receive conditional residence are also generally denied. However, that does not mean that the EB-5 dream is impossible. If investors do their research and carefully select a reputable regional center with a proven track record, such as those of the EB5AN, their chances of successfully obtaining U.S. residency dramatically increase.

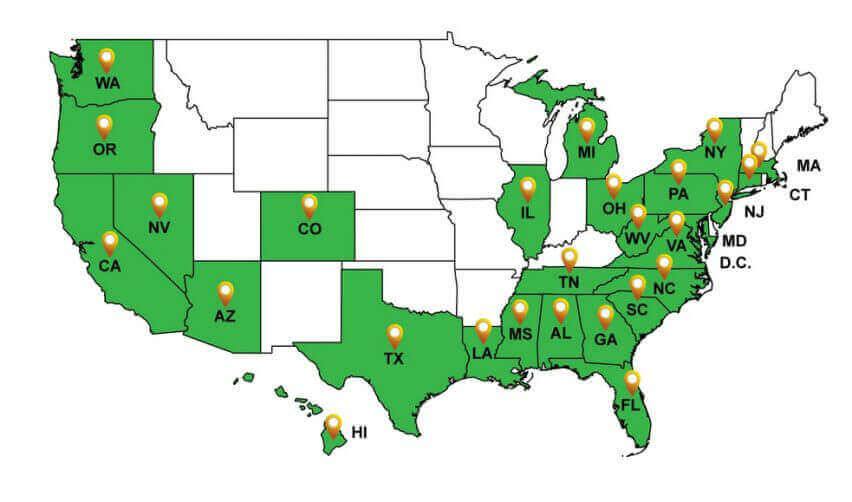

The EB5AN team owns and operates 14 regional centers across the country, boasting coverage of more than 20 states plus Washington, D.C. Regardless of investors’ preferred investment location, EB5AN ensures reliable regional centers that strictly adhere to USCIS regulations and are in no danger of termination. Renting one of EB5AN regional centers reduces wait times and offers security over the unpredictable process of investors opening their own regional centers. The network can also help investors locate projects in designated TEAs in order to reduce their investment amount. The professionalism and experience of the EB5AN team ensure their regional centers stimulate the local economy in meaningful ways and thus avoid termination.

It is crucial for investors to affiliate with reputable, experienced regional centers in order to protect their investments and ensure their future life in the US. With the increased funding requirements and widespread regional center terminations, it is now more important than ever to affiliate with true professionals in the field.