“We remain firm believers,” states Jonathan Gray, president and COO of Blackstone, “that a sustained commercial real estate recovery is underway [in 2025].”

Indeed, after a challenging post-pandemic period, U.S. real estate developers have a wealth of opportunities to build financially successful projects across a variety of asset classes.

A fluctuating economy and unstable materials prices, however, have also made it a challenge to raise sufficient funding through traditional sources.

Bureau of Labor Statistics data shows that construction input prices jumped 1.4% in January and now sit at more than 40% above their pre-pandemic level, with the New Residential Construction Input Index still up 1.9% year-over-year in May.

“Materials prices increased at the fastest monthly pace in two years in January,” observes Associated Builders and Contractors chief economist Anirban Basu, citing energy shocks, start-of-year price resets, and tariff fears as contributing factors.

Lenders have responded to this volatility by tightening terms, and developers are filling the gap with alternative capital.

A February 2025 Forbes analysis notes that EB-5 financing has become a go-to alternative when traditional bank debt grows scarce or expensive. Unlike traditional mezzanine loans, EB-5 funds typically arrive at significantly below-market rates, come with longer tenors, and carry far fewer covenants.

Because of these advantages, developers of projects ranging from hotels to mixed-use redevelopments to housing now treat EB-5 capital as a permanent fixture in the modern real-estate capital stack, pairing it with senior debt to keep projects moving even when costs spike.

A March 2025 New York Times article cites one example: “A $100 million 19-story apartment building qualifies for about $35 million of EB-5 funding. Traditional mezzanine debt financing for such a project might come with an interest rate of 10 or 12 percent … but the developer will pay 5 to 7 percent for EB-5 funding.”

The developer for this project adds, “You’re really cutting, you know, 30 to 50 percent of your cost of capital, on a rather significant portion of your capital.”

And for developers working on projects in rural areas, now is an ideal time to raise EB-5 capital: Thanks to several new immigration incentives for EB-5 investors in rural projects, the EB-5 industry has largely shifted demand to this project type.

If you’re a developer interested in taking advantage of EB-5 benefits, you may be wondering how to go about doing so.

Firstly, it’s important to understand that developers work chiefly with EB-5 regional centers. These centers market EB-5 projects and oversee the flow of funds from investors to the developing entity.

Consequently, choosing the right regional center partner is the first step in successfully raising EB-5 capital. A poorly managed regional center may fail to guarantee USCIS compliance, market a project effectively, or make the funds available to developers on time. Conversely, the best way to obtain quick access to EB-5 capital at below-market rates is to work with a regional center with a strong track record of successful projects—particularly in rural areas.

For developers, this is where EB5AN comes in.

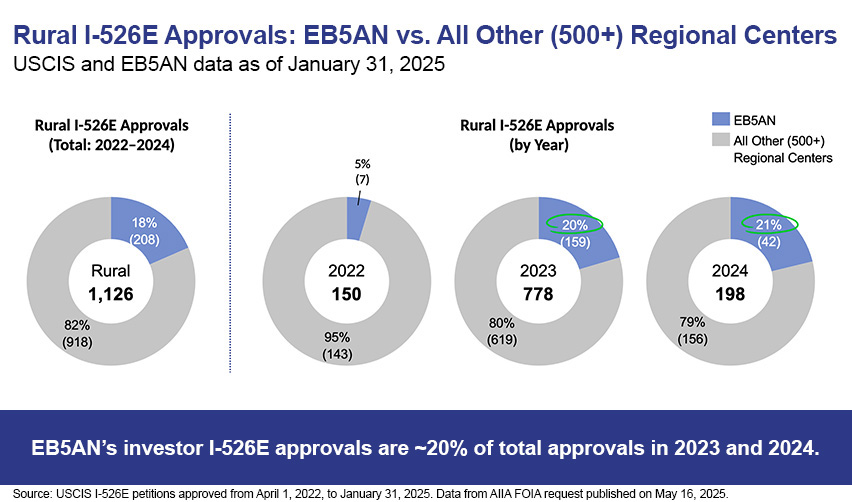

Over 1,000 EB-5 investors have chosen our rural projects since 2022, representing over $800 million in capital raised for the developers we have sponsored. And with an approximately 20% market share of the rural EB-5 industry in 2023 and 2024, no other regional center approaches our record of success in rural developments.

Developers who work with us—including some of the biggest names in single-family housing and other asset classes—can rest assured that we will handle USCIS compliance and the fund oversight process. The result will be hassle-free access to EB-5 funds, allowing you to complete your projects on time and within budget.

“We’re regularly searching for new EB-5 projects to sponsor,” states Sam Silverman, managing partner of EB5AN. “Developers can always benefit from cheap capital, and we’re ready to fulfill that need through EB-5. Our history of success with rural projects shows that we can quickly raise and deploy EB-5 capital into any rural development.”

In this article, EB5AN is pleased to report on our success in the rural EB-5 sector and explain why our developer partnerships have proven to be mutually beneficial.

EB-5: An Ideal Alternative Funding Source for Developers

Surging Demand for Rural EB-5 Projects

EB5AN Partners With Top Developers to Deliver EB-5 Funding Across Various Asset Classes

EB5AN Takes Care of USCIS Compliance, Streamlining the Process for Developers

EB-5 Investors Consistently Choose EB5AN-Sponsored Rural Projects

EB5AN Is the #1 Partner for Developers of Rural Projects

Further Reading

EB-5: An Ideal Alternative Funding Source for Developers

EB-5 funding provides developers with a significant capital injection, enabling them to secure essential financing for large-scale real estate projects that might otherwise be challenging to fund through traditional sources.

Unlike conventional loans, EB-5 capital often comes with fewer restrictions and more flexible terms, since foreign investors prioritize immigration over financial benefits and thus accept lower yields in exchange for residency. Indeed, projects that raise EB-5 capital can save 30% to 50% on their cost of capital thanks to interest rates often below market compared to traditional lenders.

Developers can also benefit from EB-5 funding’s timing and structure: Longer repayment periods ease cash-flow pressures during construction and allow more time to complete projects, and the non-recourse structure of EB-5 financing often protects developers’ other assets in case of default, offering greater financial security than traditional loans.

Additionally, EB-5 funding taps into a global pool of investors, securing contributions from several foreign nationals whose varied lawful sources of funds diversify a project’s capital structure. This broad investor base not only mitigates the risk of relying on a single funding source but also accelerates the deployment of funds into a project, allowing developers to move forward more swiftly than with bank financing.

Combined, these advantages make EB-5 an especially attractive financing option for developers seeking cost-effective, reliable, and reputation-building capital solutions.

Surging Demand for Rural EB-5 Projects

The EB-5 Reform and Integrity Act of 2022 (RIA) set in place guidelines that confer several immigration benefits upon investors who select rural projects.

Firstly, a rural targeted employment area (TEA) project requires an investment of just $800,000—well below the standard $1,050,000 minimum for non-TEA projects.

Rural petitions also receive priority processing. As a result, rural I-526E adjudications are usually taking a matter of months—not years, as was common before the RIA. EB5AN investors, for instance, are seeing approvals in under a year and as fast as six months.

Furthermore, the RIA reserves 20% of each year’s EB-5 visa allotment for rural projects. This protects Chinese and Indian applicants from the lengthy delays caused by visa backlogs. Consequently, many Chinese and Indian investors—who make up the overwhelming majority of the EB-5 demographic—can obtain their Green Cards within months rather than years.

For these myriad reasons, the EB-5 market as a whole has responded with an unprecedented demand for EB-5 projects in rural areas. And this demand is far from anecdotal—it is clearly reflected in the latest I-526E processing data covering early 2022 through January 2025. During this period, 4,329 I-526E filings were received from EB-5 investors in rural projects.

With each investment representing $800,000, rural EB-5 investors have contributed hundreds of millions into developments across the U.S. And this trend has continued to grow.

While urban EB-5 projects dominated the market before the RIA and immediately after its passage in 2022, rural filings have surged in the last 18 months. By January 2025, urban filings made up only about 40% of the total. Rural filings, meanwhile, had risen to nearly 58%.

The data tells a clear story: Now is an ideal time for developers of rural projects to raise EB-5 funding.

Does Your Project Qualify as Rural Under the EB-5 Program?

Under the EB-5 program, rural TEA status relies solely on a location’s population and geography to meet USCIS requirements.

To qualify, a rural TEA must be situated completely outside a metropolitan statistical area (MSA) as designated by the U.S. Office of Management and Budget (OMB). To do so, it must not border the outer limit of any city or town with a population of 20,000 or more residents, according to the most recent decennial U.S. Census. In addition, the total resident population of the designated area may not exceed 20,000 people based on the latest census figures. Unlike high-unemployment (urban) TEAs, which can be based on combined census tracts, rural TEAs are governed strictly by a project’s location relative to MSAs and municipal boundaries.

The definition of an MSA comes from the OMB and covers regions with interconnected urban populations and economic ties. Projects within these areas cannot qualify as rural TEAs. Similarly, any project located on the periphery of an MSA or adjacent to a municipality of 20,000 or more residents is ineligible for rural status, even if its immediate census tract is sparsely populated.

As part of the petition process, investors must include clear third-party demographic data in their Form I-526E petition to prove their project meets the standards for rural TEA status. USCIS accepts official population statistics from the latest national census and geographic definitions from the OMB as valid evidence of a rural area. These figures must reflect conditions on the date the investment is made or the petition is filed, since outdated data may lead USCIS to reject rural TEA claims.

To help developers determine whether their projects qualify as rural, we have developed an online TEA qualification map. Developers can input any address in the United States and immediately discover whether it fulfills USCIS’s criteria for rural status.

EB5AN TEA Map—Discover if Your Project Qualifies as Rural

EB5AN Partners With Top Developers to Deliver EB-5 Funding Across Various Asset Classes

EB5AN regularly works with developers to structure favorable EB-5 deals. Since 2013, we have sponsored more than 15 EB-5 projects across multiple asset classes.

Our projects’ total development costs have exceeded $2.9 billion, and every single EB-5 fund has either been repaid or is in good standing.

“The principals at EB5AN have significant experience in real estate capital,” points out Mike Schoenfeld, a managing partner at EB5AN. “We’re always one step ahead of the market to catch wind of trends and sponsor truly successful developments in rural areas.”

Achieving this requires tireless effort on EB5AN’s part. As Schoenfeld notes, “We constantly search for new projects to sponsor and work closely with developers to ensure the EB-5 funds are deployed in a timely manner and on terms favorable for builders.”

EB5AN’s rural EB-5 offerings have been particularly successful and represent a variety of property types.

The following is a brief overview of our current portfolio of rural projects:

- Bay Creek (Loan): Bay Creek is a master-planned residential community in Cape Charles, Virginia, on the Chesapeake Bay. As planned, the project will expand existing community infrastructure, sell 340 residential land lots, and build and sell 61 homes. Additionally, work on the project is expected to enhance existing amenities that define the Bay Creek lifestyle. The project will continue to refine Bay Creek’s two award-winning golf courses designed by golf legends Arnold Palmer and Jack Nicklaus.

- Tamarack Resort (Loan): Tamarack Resort is a master-planned, all-seasons resort being developed by MMG Equity Partners. This project includes world-class amenities and is America’s only ski, golf, and lake resort. It offers 1,100 skiable acres with 50 runs, an 18-hole championship golf course, and a full-service 200-slip marina.

- Rocky River (Loan): Rocky River is a 1,120 single-family home community with amenities that is being developed by Kolter Homes. This Cresswind community is an age-restricted, 55+ active adult community in Locust, North Carolina, about 45 minutes from Charlotte, North Carolina.

- Twin Lakes Georgia (Loan): Twin Lakes is a 1,300 single-family home community development being developed by Kolter, with 787 homes already sold as of June 2025. Twin Lakes Georgia was named the 55+ Housing Community of the Year at the 2023 Annual OBIE Awards gala. In addition, the community also won Gold awards in Best Landscape Design and Best Amenity.

Besides these, EB5AN has sponsored a variety of successful projects now closed for investment. Across these projects, we have gained extensive experience sponsoring single-family homes, condominiums, hotels, upscale ski/golf communities, country club–style properties, and more.

In the hospitality sector in particular, we have sponsored high-profile developments under the Marriott, Hyatt, and Westin brands.

Our diverse portfolio has led us to collaborate with a number of leading developers, including The Kolter Group, one of the leading builders in the Southeast.

Our Partnership With Kolter, a Leading Developer

Founded in 1997, The Kolter Group has grown into a diversified real estate development and investment leader based in Palm Beach County, Florida.

With projects valued at more than $30 billion and over 290 years of combined experience among its leadership, Kolter has delivered upwards of 27,000 units across more than 100 residential developments—and in its 28-year history, it has never failed to complete a project or repay a loan.

Organized into five strategic divisions, Kolter has earned acclaim for its master-planned communities, luxury high-rise condominiums, multifamily apartments, and branded hotels throughout the Southeast. Its affiliate, Kolter Multifamily, has sponsored nearly $1.6 billion in urban and suburban rental communities, while Kolter Urban brings striking luxury condominium residences to vibrant downtown and waterfront locations in Florida and Georgia.

Under the RIA, EB5AN has partnered with Kolter on several rural EB-5 funds—notably VUE Sarasota and Saltaire St. Petersburg (Fund X)—both of which have already repaid their investors.

Our collaboration with Kolter exemplifies the kind of high-quality rural projects we seek to structure with EB-5 capital, and it serves as just one illustration of our continued commitment to delivering exceptional outcomes for investors and developers alike.

EB5AN Takes Care of USCIS Compliance, Streamlining the Process for Developers

EB-5 offerings are subject to numerous specific requirements under USCIS. Without proper guidance, preparing an EB-5 offering may be challenging for developers, especially those without significant experience in the EB-5 industry.

But EB5AN makes the EB-5 as quick and hassle-free as possible for developers, ensuring that USCIS standards are met and the project is marketable to EB-5 investors.

Form I-956F

Form I-956F, Application for Approval of an Investment in a Commercial Enterprise, is used by USCIS to verify that an EB-5 offering is compliant with its policies. These policies include the confidential offering memorandum, partnership or loan agreements, business plan, economic impact analysis, TEA qualification reports, conflict-of-interest disclosures, and policies for monitoring securities sales.

Once it receives I-956F approval, an EB-5 project is considered compliant and will likely become more attractive to investors, whose petitions will now face less scrutiny on the project side.

EB5AN’s Approval History

We are pleased to announce that all of our EB-5 projects continue to enjoy a 100% USCIS approval rate—without receiving any requests for evidence.

In fact, our team at EB5AN has achieved 18 I-956F approvals—to our knowledge, more than any other regional center—raising the bar for both speed and consistency in USCIS compliance. This industry-leading standard underscores our commitment to guiding projects through the EB-5 process with exceptional reliability.

Remarkably, our quickest I-956F approval was issued in just 1.6 months, compared with the industry average of 8.5 months. That rapid turnaround reflects our deep expertise in navigating evolving EB-5 regulations and our agility in responding to changes in law and policy—ensuring that our partners benefit from both speed and certainty.

EB-5 Investors Consistently Choose EB5AN-Sponsored Rural Projects

EB5AN’s rural EB-5 record now entails over 1,000 investors and more than 400 approved I-526E petitions, accounting for roughly 20% of all rural approvals in 2023 and 2025. That market share far outpaces our share of filings, a testament to the quality of our project documentation and our rigorous approach to compliance.

Our approval timelines speak for themselves. Detailed processing data shows that the vast majority of our rural I-526E petitions clear USCIS review within a few months, with overall times steadily shrinking since mid-2024. Some of our investors have seen approvals in under six months, and many already hold their physical U.S. Green Cards.

Form I-526E is the essential first step for EB-5 applicants, and its approval unlocks conditional permanent residency—allowing holders to live, work, and travel freely. Before the RIA, applicants often waited a year or more for that milestone; today, rural investors routinely reach this stage in mere months.

Beyond speed and volume, our projects deliver lasting impact. From Twin Lakes Georgia’s equity and loan structures to developments at Rocky River and Tamarack Resort, we guide each offering from concept through USCIS approval faster than the industry norm. And by generating over 20,000 EB-5-compliant jobs—a number that has far exceeded the 10-job minimum per investor—our track record reinforces both the economic benefits of rural investment and our proven expertise in securing timely, favorable outcomes.

EB5AN Is the #1 Partner for Developers of Rural Projects

When it comes to securing fast, affordable, and hassle-free EB-5 capital for rural developments, EB5AN leads the industry.

With our industry-leading I-956F pre-approvals, streamlined I-526E processing, below-market interest rates, and specialized rural TEA expertise, we deliver the funding you need—exactly when you need it—so you can focus on building great projects instead of raising capital.

For rural real estate financing that’s fast, cheap, and convenient, EB5AN is the #1 choice.

To discuss your capital needs with us or for help with EB-5 compliance, schedule a free consultation with EB5AN.