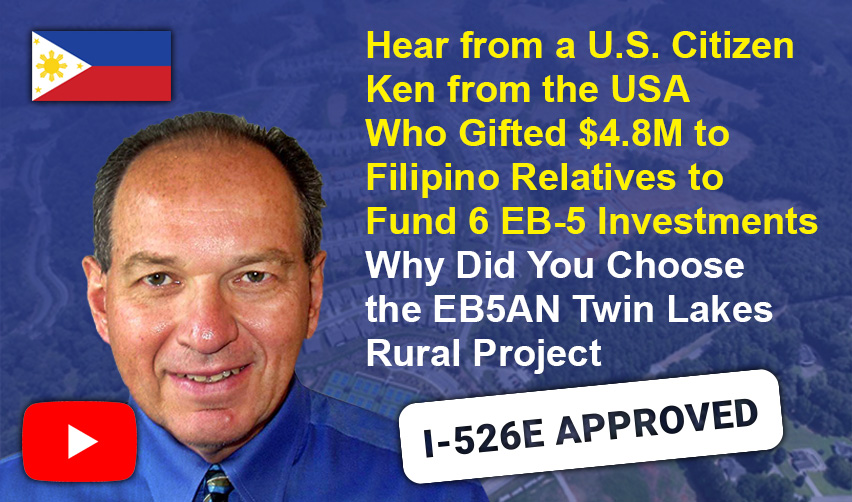

I’m Ken Geraghty, a former financial services and real estate professional. I am here to share my personal journey with the EB-5 investment program. I believe that my insights will be valuable for anyone considering an EB-5 investment.

Through my experience, you will learn how to evaluate EB-5 investment opportunities and invest in the safest projects for both immigration success and a positive financial outcome. In this extended article, I will provide more in-depth information about my decision-making process and the factors I considered when selecting an EB-5 investment project.

Why I Chose the EB-5 Immigration Path

Selecting an Immigration Attorney

Why I Chose EB5AN’s Twin Lakes Rural Project

- Comparing Twin Lakes to Other EB-5 Investments

- Impact of Rising Interest Rates on Real Estate Development

Navigating the EB-5 Process

Looking to the Future

Why I Chose the EB-5 Immigration Path

I am from Queens, New York, and spent 30-plus years in the corporate world, mostly in financial roles, in financial services. After retiring, I was involved in real estate development in Las Vegas.

I got involved in the EB-5 investment program because my wife, who is Filipina, has a large family in the Philippines. We wanted to bring six of her relatives to the United States. After trying various visa routes without success, we discovered the EB-5 investment opportunity.

Through thorough research and consultations, I learned that this program was a good fit for our goals—it was faster and more straightforward than other options. So, I gifted the needed capital ($4.8 million total) to my wife’s six relatives so they could invest in an EB-5 project. Their EB-5 applications have already been submitted.

Selecting an Immigration Attorney

In my quest to understand the EB-5 program better, I talked to several immigration lawyers and eventually chose Anahita George to represent my wife’s relatives. She was easy to work with and available. Also, she was sponsoring her sister through the EB-5 program, investing in the same project I did: EB5AN’s Twin Lakes rural project. Her commitment to the same project, along with her impressive track record, gave me confidence.

Why I Chose EB5AN’s Twin Lakes Rural Project

As someone with experience in both finance and real estate development, I had specific criteria for selecting an EB-5 project. I ultimately chose the Twin Lakes rural project because of its developer’s impeccable track record and the favorable demographics of the Southeast region near Atlanta. The project’s location in a prospering and growing area, coupled with the quality of the development itself, also made it an attractive investment option.

First, the developer’s reputation and track record played a crucial role in my decision-making process. Kolter Homes has a history of successful developments, and their experience in the industry instilled confidence in their ability to see the project through to completion.

Another critical factor in my decision was the regional center’s reputation and past performance. EB5AN, the regional center managing the Twin Lakes project, has an excellent track record of helping investors achieve their immigration goals. Their dedication to investor success, combined with their experience in managing EB-5 projects, made them an ideal partner for my investment. The EB5AN team was easy to work with and always accessible.

Comparing Twin Lakes to Other EB-5 Investments

When comparing the Twin Lakes project to other EB-5 investments, like those in the Bay Area, I considered factors like population migration patterns, housing costs, and local economies. The Bay Area is currently experiencing an exodus of talent, making it a riskier investment option. In contrast, people are migrating toward Atlanta, increasing the demand for housing in the area.

One aspect that stood out for me when comparing EB-5 projects was job creation potential. A critical requirement for an EB-5 investment is to create at least ten full-time jobs for US workers. If a project is unable to create at least 10 jobs per EB-5 investor, the investors won’t get their Green Cards.

Twin Lakes has already created all the needed jobs for all EB-5 investors, which is a huge advantage. This makes it much more likely for investors in Twin Lakes to immigrate successfully.

Impact of Rising Interest Rates on Real Estate Development

As someone with a background in finance, I understand that rising interest rates can affect real estate development. Projects without financing lined up in advance can face challenges in securing funding, and higher interest rates can make it more expensive for developers to borrow money. This, in turn, can lead to higher construction costs and potentially slower development timelines.

However, I was confident in the Twin Lakes project’s financial stability and Kolter’s ability to manage these challenges.

The Twin Lakes project had already secured financing, which meant that it was less exposed to fluctuations in interest rates. Additionally, the developer’s track record of success demonstrated their ability to navigate complex financial environments and deliver quality projects on time and within budget. Kolter has never failed to complete a project or to repay a loan.

This confidence in the developer’s financial management skills and the project’s financial stability helped mitigate concerns about the impact of rising interest rates on the project’s success.

Navigating the EB-5 Process

The EB-5 investment process can be complicated, and having the right team in place is essential for success. In my experience, working with a knowledgeable immigration attorney and a reputable regional center was crucial in navigating the process smoothly. Anahita was instrumental in guiding me through the various steps of the EB-5 investment process and ensuring that all documentation was properly submitted.

Probably the most challenging part of the process was compiling the source-of-funds documentation for each applicant’s I-526E application. Anahita’s guidance during this stage was a great help.

Additionally, the regional center played a critical role in the investment process. EB5AN, the regional center managing the Twin Lakes project, provided support throughout the investment period and offered valuable insights into the project’s progress. Their expertise and experience in managing EB-5 investments were invaluable to me as an investor.

Looking to the Future

As the Twin Lakes project progresses and my EB-5 investment journey continues, I am optimistic about the outcome. The project is well underway, with homes being built and sold at a steady pace. In fact, over 500 homes have already been sold to date.

I am confident that this development will continue to thrive, providing a safe investment and a pathway to permanent residency for my wife’s family. By thoroughly researching and evaluating various EB-5 investment options, I was able to select a project that met my immigration and financial goals.

For those considering an EB-5 investment, I would highly recommend conducting extensive research, consulting with experienced professionals, and considering factors such as developer reputation, regional center performance, and project location. By doing so, you can make an informed decision that maximizes your chances of success in both immigration and financial outcomes.