EB-5 remains one of the most direct paths to permanent residency for families who want more control over their U.S. immigration timeline—especially professionals navigating H-1B limitations and lengthy employment-based green card backlogs.

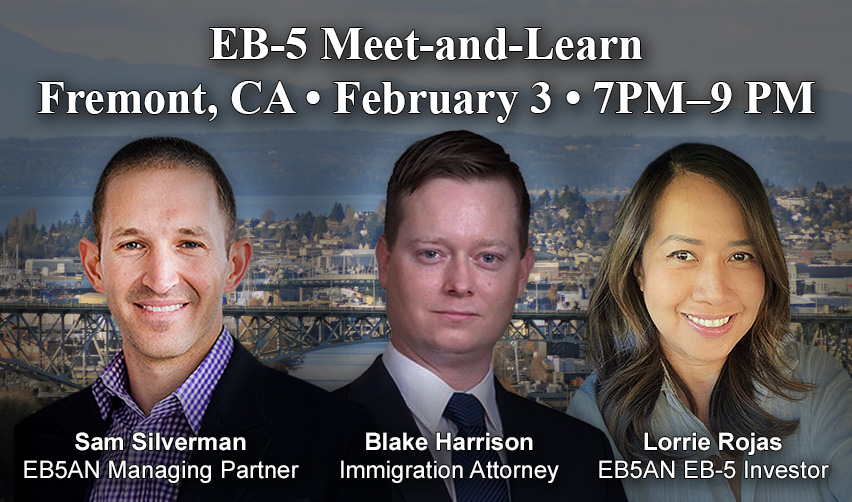

On Tuesday, February 3, 2026, EB5AN’s founder and managing partner Sam Silverman will host a two-hour in-person presentation and Q&A for prospective EB-5 investors at the Fremont Marriott Silicon Valley. The session will focus on current EB-5 policy, what recent USCIS developments mean in practice, and how investors should think about selecting a project in today’s market. This event will also feature two guest panelists: immigration attorney Blake Harrison and EB-5 investor Lorrie Rojas, who will join the discussion and Q&A to share practical perspectives from both the legal and investor sides of the EB-5 process.

If you are in the Bay Area, we invite you to join us for an evening of actionable EB-5 insights and open discussion.

Date, Time, and Location

What to Expect

Topics for Discussion

- Why H-1B Professionals Are Turning to EB-5

- Current Filing and Adjudication Trends

- RIA Policy and USCIS Compliance: What Has Changed in Practice

- Rural vs. Urban EB-5 Projects: Timing, Strategy, and Tradeoffs

- How to Evaluate an EB-5 Project in 2026

- Common Pitfalls: Avoidable Mistakes That Cost Investors Time and Money

- Choosing the Right Immigration Attorney

Meet the Host

Guest Panelists

Register for the Event Today: Space is Limited and Advance Registration is Required

Date, Time, and Location

Date: Tuesday, February 3, 2026

Time: 7 p.m. – 9 p.m. PST

Venue: Fremont Marriott Silicon Valley

Address: 46100 Landing Parkway, Fremont, California, 94538

What to Expect

This event is designed to be practical and investor-oriented. You can expect:

- A clear overview of the EB-5 program as it operates today

- Policy and processing insights under the EB-5 Reform and Integrity Act of 2022 (RIA)

- A framework for evaluating EB-5 project quality and investor protections

- A panel-style discussion with EB5AN leadership, an immigration attorney, and an EB-5 investor

- Time for candid Q&A

Topics for Discussion

Why H-1B Professionals Are Turning to EB-5

H-1B professionals often look to EB-5 because it can offer:

- A green card strategy not dependent on employer sponsorship

- A clear path to permanent residency for the principal investor, spouse, and unmarried children under 21

- A process anchored in a qualifying investment and U.S. job creation, rather than annual visa lottery constraints or employer-driven timelines

Current Filing and Adjudication Trends

EB-5 investors should understand how trends may affect real-world outcomes:

- What current I-526E adjudication patterns suggest (and what they do not)

- How to interpret processing updates, RFE trends, and case workflow realities

- Practical expectations around milestone timing

RIA Policy and USCIS Compliance: What Has Changed in Practice

RIA reshaped EB-5 oversight and compliance expectations:

- What investors should know about regional center compliance and USCIS oversight

- How project documentation has evolved post-RIA (and why it matters)

- Key concepts that frequently drive investor questions—such as fund administration, reporting expectations, and transparency

Rural vs. Urban EB-5 Projects: Timing, Strategy, and Tradeoffs

Project type is not just a marketing label—it can affect strategy:

- Rural vs. urban projects and what those classifications can mean for prioritization and visa availability

- How set-aside categories factor into planning (and what investors should watch for)

- Tradeoffs that matter beyond visa strategy, including execution risk, construction timelines, and job creation pacing

How to Evaluate an EB-5 Project in 2026

Investors should evaluate projects like institutional lenders do—methodically and with a focus on downside protection:

- Capital stack structure (senior debt, EB-5 capital, developer equity) and why position matters

- Collateral and security package considerations

- Sponsor track record and alignment of incentives

- Construction status, third-party contractors, and budget controls

- Repayment/exit pathways and what “repayment plan” really means

Common Pitfalls: Avoidable Mistakes That Cost Investors Time and Money

We will address frequent issues that can delay or complicate an EB-5 case:

- Source-of-funds preparation pitfalls and documentation expectations

- Overreliance on marketing claims without verifying the underlying documents

- Underestimating how project structure and timelines can affect immigration outcomes

Choosing the Right Immigration Attorney

Selecting counsel is one of the most important early decisions:

- What to look for in an EB-5 attorney (experience, workflow, responsiveness, and documentation rigor)

- How to coordinate effectively between investor, attorney, and regional center

- What investors should ask before signing a retainer

Meet the Host

Sam Silverman – Managing Partner, EB5AN

Sam Silverman brings extensive experience in real estate development, finance, and strategic consulting across the United States and China. Before founding EB5AN, he served as Director of Corporate Strategy for professional golfer Jack Nicklaus in Beijing and previously worked at The Boston Consulting Group advising Fortune 500 companies worldwide. A Forbes 30 Under 30 National Winner for Social Entrepreneurship and frequent Wall Street Journal contributor on EB-5 topics, Sam holds a B.A. in Economics from Yale University and an M.B.A. from Stanford University.

Guest Panelists

Blake Harrison – Immigration Attorney

Blake Harrison is the founder and president of Harrison Law Office and practices exclusively in U.S. immigration law. He has more than eight years of experience representing clients across investment, family, employment, humanitarian, and naturalization-based matters.

Lorrie Rojas – EB-5 Investor

Lorrie is an EB-5 investor from the Philippines with an approved I-526E petition. She invested in EB5AN’s Hyatt Fort Lauderdale EB-5 project and will share an investor perspective on evaluating a project, preparing to file, and navigating the process in practice.