Form I-526E is the initial petition filed by EB-5 visa applicants, and it constitutes one of the most important steps toward obtaining an EB-5 Green Card.

The I-526E petition is an EB-5 investor’s first contact with USCIS, where the applicant provides proof of his investment, his source of funds, and the EB-5 project he selected.

USCIS holds a high evidentiary standard for Form I-526E, particularly for the source-of-funds section. Consequently, EB-5 immigration attorneys focus much of their practice on satisfying USCIS’s scrutiny and tracing EB-5 capital to its source in detail.

An EB-5 investor’s immigration outcome relies on an I-526E approval. Once approved, EB-5 investors can receive their initial U.S Green Cards and begin their two-year period of conditional permanent resident status.

With an $800,000 investment and immigration plans on the line, EB-5 applicants understandably want to secure a swift I-526E approval from USCIS.

Fortunately, your chances of being approved for Form I-526E have statistically never been higher. USCIS has released I-526E processing data covering April 2022 through January 2025, and the I-526E approval rates for this period are staggering.

As of the most recent data, the overall I-526E approval rate stands at 97%, a historic high for the EB-5 Immigrant Investor Program. To a great extent, the favorable adjudication outcomes for I-526E applicants can be attributed to clearer USCIS standards under the EB-5 Reform and Integrity Act of 2022 (the RIA), particularly the new mandatory Form I-956F for each EB-5 project.

Full Webinar and Analysis of I-526E Processing Data

A Historic Look at I-526(E) Approval Rates

Current I-526E Approval Rates

Why I-526E Approval Rates Are High

What High I-526E Approval Rates Mean for You

A Historic Look at I-526(E) Approval Rates

Prior to the implementation of the EB-5 Reform and Integrity Act of 2022 (RIA), Form I-526 petitions historically exhibited approval rates well below 75 percent. Over many years leading up to the RIA, USCIS adjudicators applied a combination of regulatory guidance and internal policy manuals when reviewing investor submissions. In practice, this resulted in significant variability and uncertainty in approval outcomes.

Although precise quarterly figures from the pre-RIA era are not available in the newly released dataset, the consensus is that the pre-RIA period offered little assurance of consistent outcomes, and many investors opted to delay filing until greater clarity emerged.

Compared to the current EB-5 policies, the expectations for investors and immigration attorneys in Form I-526 were far less specific than they are now under the RIA; the RIA has neatly codified much of USCIS’s adjudication standards for the I-526 petition.

Under the RIA, the vast majority of EB-5 investors, who invest through regional centers now file Form I-526E instead of Form I-526.

Current I-526E Approval Rates

USCIS has released new processing statistics as a result of Freedom of Information Act (FOIA) requests, covering the period from April 1, 2022 (just after the RIA’s enactment) through January 31, 2025. The data provide the first comprehensive view of I-526E receipts and adjudications under the RIA.

According to USCIS’s own figures, a total of 9,878 Form I-526E filings were received by January 31, 2025. Of these, 5,191 petitions—approximately 52.6 percent—were filed in the high-unemployment (urban) visa category, while 4,329 petitions (about 43.8 percent) were filed in the rural set-aside category.

Quarterly I-526E filing volumes have shifted markedly since the RIA took effect. In the first year after implementation, urban filings outpaced rural filings by nearly a two-to-one ratio, largely because the rural category was new and investors needed time to understand its benefits. However, over the 18 months preceding January 2025, rural filings steadily surged. By the end of the period, rural petitions accounted for roughly 58 percent of all new I-526E receipts, while urban filings declined to approximately 40 percent.

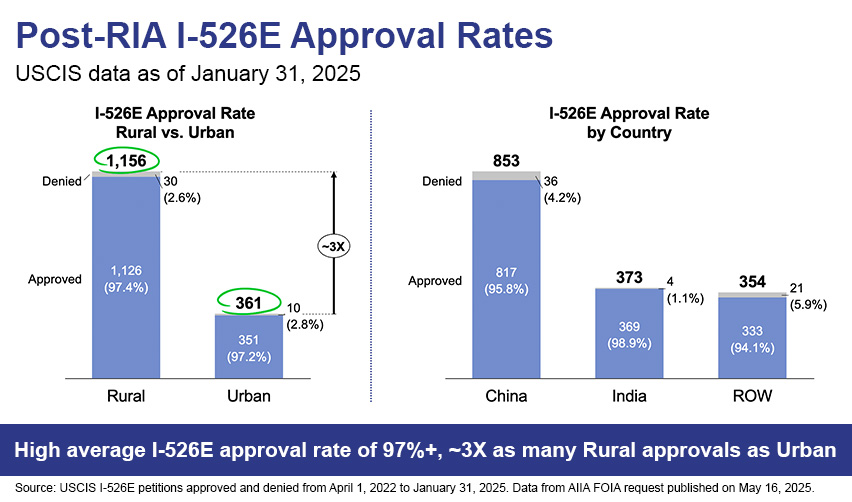

In this new environment for the EB-5 market, approval rates under the RIA have climbed to historic highs. According to the USCIS data for petitions adjudicated through January 31, 2025, the overall approval rate for I-526E petitions stands at approximately 97 percent.

This figure far exceeds pre-RIA averages and shows a marked improvement in investor success rates. It is important to note that this 97 percent figure does not account for pending requests for evidence (RFEs) or NOIDs, which may slightly lower the ultimate approval percentage once resolved. Nevertheless, even when factoring in likely denials triggered by pending issues, the approval percentage remains significantly higher than before the RIA.

Interestingly, most I-526E approvals are going to investors in rural—not urban—EB-5 projects.

Specifically, as of January 31, 2025, USCIS had processed over 1,100 rural I-526E petitions, representing roughly 27 percent of the 4,329 rural filings. By contrast, only about 361 urban petitions (approximately 7 percent of the 5,191 urban filings) had been adjudicated during the same period. These figures illustrate that, although urban filings outnumbered rural filings by approximately 20 percent through January 2025, rural petitions saw nearly three times as many absolute approvals. Put differently, the rural adjudication ratio versus total rural receipts was around four times higher than the corresponding urban ratio.

Focusing more narrowly on the period from February 1, 2023, through January 31, 2025, the adjudication gap grows even starker. In those 24 months, USCIS processed only 74 urban petitions out of 4,521 urban filings—a processing rate of just 1.5 percent. During that same 24-month window, USCIS adjudicated 967 rural petitions out of 4,095 rural filings, a processing rate of approximately 24 percent. Thus, the rural-to-urban adjudication ratio in favor of rural stands at roughly 13:1 for this period.

On average, for every urban petition USCIS processed between February 2023 and January 2025, USCIS processed thirteen rural petitions.

Taken together, the FOIA data demonstrates two central points about current rates: (1) overall I-526E approval rates are about 97 percent, a historic high compared to the pre-RIA era; and (2) rural petitions receive a clear processing priority, both in terms of speed and volume. Urban petitions, by contrast, remain largely pending, with fewer than 2 percent completed over a two-year span.

Why I-526E Approval Rates Are High

The unprecedented approval rates for I-526E petitions under the RIA can be attributed primarily to the more transparent and consistent standards introduced by the new law. Before the RIA, USCIS adjudicators often relied on less defined interpretations of financial documentation requirements and regional center obligations, leading to less predictable outcomes. The RIA, however, codified clearer requirements. Under the RIA’s framework, USCIS now provides more detailed guidance on what constitutes qualifying source-of-fund documentation, acceptable regional center oversight, and investor job-creation projections.

By establishing well-defined compliance checkpoints, the RIA limits uncertainty. As a result, USCIS adjudicators, EB-5 attorneys, and investors have a clearer idea of what constitutes a successful I-526E submission.

The Role of Form I-956F

Form I-956F, a requirement for EB-5 projects under the RIA, is a noteworthy example.

Each EB-5 project—whether rural or urban—must submit precise economic analyses, job-creation forecasts, and evidence of capital disbursement through the I-956F petition. USCIS’s tighter scrutiny of project documentation makes it easier for any deficiencies in a project to be corrected before filing.

EB-5 projects will not be allowed to accept EB-5 capital until they have filed Form I-956F. In effect, the RIA incentivizes regional centers and project sponsors to prepare fully compliant I-956F packages.

We believe this important new policy has ultimately resulted in a higher industry-wide level of compliance. EB-5 investors certainly benefit, as EB-5 projects on the market are more likely to take USCIS compliance seriously.

And since project documentation is a crucial component of the I-526E petition, Form I-956F may be a contributing factor to higher I-526E approval rates.

What High I-526E Approval Rates Mean for You

Investor Confidence

The shift to nearly 97 percent approval rates for Form I-526E petitions under the RIA has numerous ramifications for current and prospective EB-5 investors. At a broad level, consistently high approval percentages result in confidence in the EB-5 program’s integrity and predictability. In an era when potential changes in administrative policy—particularly under the new Trump administration—raise concerns, the data confirm that EB-5 remains a viable and stable immigration pathway, especially for those choosing rural projects.

Significant Volume of Rural I-526E Adjudications

High approval percentages alone do not guarantee fast adjudication for all petition types. The data clearly show that rural petitions benefit from both priority processing and superior adjudication outcomes relative to urban petitions. For rural investors, a typical processing window—once the petition is filed and deemed complete—ranges from eight to ten months from submission to approval. In contrast, urban petitions languish in the queue, with fewer than 2 percent processed over a two-year window. Although urban petitions remain technically current (i.e., no cut-off date has been announced), the high backlog risk means that investors could face indefinite delays. For prospective investors, choosing a rural EB-5 project not only maximizes the probability of petition approval but also substantially reduces the timeline to conditional permanent residence.

Given that rural petitions are drawing on a separate visa set-aside and currently claim fewer than half of available rural visas, the likelihood of a rural cut-off date materializing in the near term is remote. And even though urban approvals are low, USCIS could possibly implement a backlog based on the number of pending urban I-526E petitions.

Consider Your Regional Center’s History of I-956F Approvals

Investing in an EB-5 project with I-956F approval does not guarantee success, but it can lower your risk. Again, a project with I-956F approval has already been evaluated by USCIS and found compliant.

Conversely, if a regional center has a poor record of I-956F approvals, and you invest in one of its projects, that project may receive an I-956F denial from USCIS.

For EB-5 investors, the best practice is to either invest in a project that has already received Form I-956F approval or whose regional center has a strong record of I-956F approvals.

EB5AN is pleased to report that we have received 17 I-956F approvals from USCIS.

USCIS granted some of EB5AN’s Form I-956F approvals in under three months, with the fastest approval in just 1.6 months. This means our Form I-956F processing times are significantly faster than the industry average. EB5AN’s last eleven Form I-956F approvals were all processed faster than the USCIS average processing time of 6.0 months.

“More and more EB-5 investors in rural projects are receiving quick I-526E approvals,” says Sam Silverman, managing partner of EB5AN, “These investors are on a remarkably fast timeline to becoming permanent residents of the United States. We believe now is the time to consider an EB-5 investment and seize this unprecedented opportunity under the EB-5 Reform and Integrity Act of 2022.”

For further information on getting started on EB-5 immigration, schedule a free consultation with EB5AN.