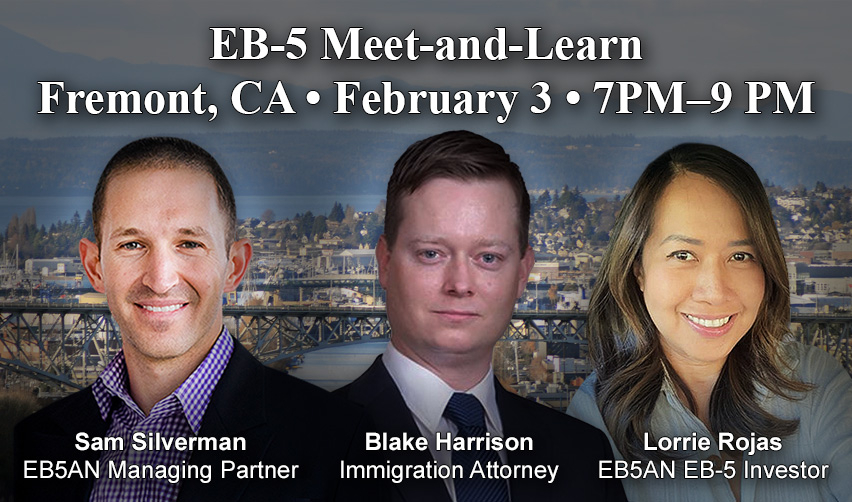

EB5AN recently hosted a highly informative event in the Bay Area, drawing a group of prospective EB-5 investors, many of whom are on H-1B and other work visas. Attendees had the opportunity to learn about the EB-5 Immigrant Investor Program, investment opportunities, and the Green Card process in a collaborative environment. The session provided clarity on complex immigration rules, investment structuring, and project due diligence, giving participants the confidence to make well-informed decisions about their path to permanent residency in the United States. This recap provides an overview of key insights shared during the event.

Visa, Green Card, and Travel Insights

Investor Experiences

Understanding EB-5 Projects

Due Diligence and Risk Management

Investment Timing and Process

Program Considerations

Key Takeaways for Prospective Investors

Visa, Green Card, and Travel Insights

A major topic of interest for attendees was navigating the U.S. immigration process while investing in EB-5 projects. Immigration attorney Blake Harrison clarified an important point about travel for H and L visa holders: “Typically, when you file I-485, you really can’t leave the country on advance parole without abandoning that application. So the H and L visas are the exception.”

This means that investors on H-1B or L-1B visas can continue traveling internationally even after filing their I-485, using either their original visa or Advance Parole (AP). Employment Authorization Documents (EADs) function the same across visa types, offering flexibility for work while waiting for the Green Card. Once the EB-5 investment is made, filing the I-485 application can begin immediately, ensuring investors start the process without delay.

Investor Experiences

EB5AN EB-5 investor Lorrie Rojas shared her personal journey from F-1 student visa to permanent resident through EB-5. Originally from the Philippines, Lorrie attended graduate school at UC Berkeley and discovered EB-5 while researching ways to stay in the U.S. She highlighted the importance of working with reputable regional centers and developers: “I spoke with some EB-5 companies, but I felt very comfortable with EB5AN because of their transparency and because of the credibility of the founders, Sam and Mike. They also have really good projects, and I invested in one of the Kolter projects, because Kolter, they have a perfect track record and they have a long financial history of loans being repaid on time.”

Her experience demonstrates how EB-5 investment, combined with professional guidance, can lead to a successful Green Card process. Lorrie invested in a Kolter project and received regular quarterly investment reports and a K-1 form, ultimately obtaining her permanent residency.

Understanding EB-5 Projects

EB5AN managing partner Sam Silverman presented seven current EB-5 projects, emphasizing transparency, proven track records, and the importance of due diligence. Projects ranged from rural master-planned communities like Bay Creek in Virginia and Twin Lakes in Georgia to urban developments such as Terra Ceia in Florida.

Key distinctions between rural and urban projects include loan terms, investment duration, and speed of Green Card processing. Rural projects often offer faster priority processing for immigration purposes, whereas urban projects generally provide shorter investment timelines. Investors can choose between a loan option, which is lower risk and repaid first, and an equity option, which typically offers higher returns but is paid after all debts.

For example, Twin Lakes, a 55-and-up community in Hoschton, Georgia, has already sold over 850 homes and created more than 4,500 EB-5-eligible jobs, demonstrating a strong track record of execution. According to Sam, “It’s a lot easier to evaluate risk if you can say… 100 homes being built and they’ve already sold 70 of them… your risk is more informed.”

Due Diligence and Risk Management

Standard due diligence includes reviewing all project documents; Private Placement Memorandum (PPM), business plans, economic impact reports, financial statements, and government approval letters. Investors are encouraged to visit projects in person when possible, but even remote evaluation through Google Earth, sales records, and project videos can provide sufficient insight.

EB5AN emphasizes proof of execution as a core risk metric. Established developers with strong track records, like Kolter, reduce investment risk. With nearly $40 billion in development history and 90 active projects, Kolter has never failed to complete a project or repay a loan.

Investment Timing and Process

The investment process begins with transferring funds into an escrow account, followed by filing the EB-5 application. Once the government issues a receipt notice, the funds are made available to the project, typically drawn within six months. The loan term starts when the money is used, not when it is initially transferred.

This timing is important for Green Card applications. Investors can file I-485 immediately after making the EB-5 investment.

As for the removal of conditions, Sam clarified, “You only have to show that the funds have been used at the I-829…it’s going to take you at least two years before you’d be able to file for the I-829.”

Program Considerations

During the event, participants also discussed the EB-5 Regional Center program, which requires reauthorization by September 2027. While uncertainty exists regarding future program rules, grandfathering ensures that anyone filing before September 2026 retains protections. Even if the program lapses, regional centers continue to manage reporting for existing projects, as happened during the 2019 lapse.

Key Takeaways for Prospective Investors

The Bay Area event offered a thorough overview for prospective EB-5 investors on H-1B and L-1B visas. Attendees gained clarity on the visa and Green Card process, EB-5 project selection, investment timing, and risk management. Highlighting successful projects like Twin Lakes and Bay Creek, Sam and the EB5AN team provided attendees with actionable insights to make informed investment decisions while navigating the path to U.S. permanent residency.

For those considering EB-5 investment, this event demonstrated that with the right guidance, due diligence, and project selection, the EB-5 program can be a viable and structured pathway to a U.S. Green Card.

For anyone who could not attend, EB5AN will continue hosting similar events across the country, along with private one-on-one consultations. These sessions are designed to offer practical guidance and help families explore their EB-5 options with a clear understanding of the process.

More than 2,700 families from over 70 countries have selected EB-5 projects sponsored by EB5AN regional centers. Our expert team has more than a decade of experience and offers clients high-quality, low-risk EB-5 regional center projects with a 100% USCIS project approval rate.

If you would like to know more about your EB-5 investment options, book a free call with our expert team today.