As the EB-5 industry continues to evolve under the EB-5 Reform and Integrity Act of 2022 (RIA), EB5AN has emerged as a clear leader in the rural segment of the market. Since the implementation of the RIA—which introduced visa set-asides and priority processing for rural EB-5 projects—EB5AN has consistently ranked among the top regional centers by rural petition volume.

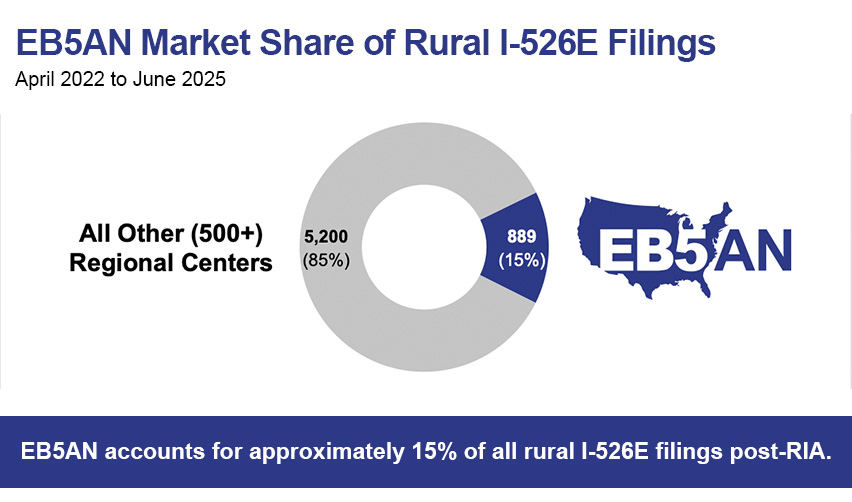

Comparing EB5AN investor I-526E filing data to recently released data from U.S. Citizenship and Immigration Services (USCIS) confirms that EB5AN-sponsored projects account for approximately 15% of all rural I-526E petitions filed since the RIA.

EB5AN Continues to Lead the Rural EB-5 Market

Why Investors Continue to Choose EB5AN

Current EB5AN Rural Offerings

A Proven Track Record of Success

Learn More

EB5AN Continues to Lead the Rural EB-5 Market

EB5AN has established itself as one of the most trusted and successful regional centers in the United States, consistently maintaining a double-digit share of all rural I-526E petitions filed since the RIA took effect.

According to recently published USCIS data, EB5AN-sponsored projects account for approximately 15% of all rural I-526E petitions filed since the RIA’s passage—solidifying EB5AN’s position as a national leader in the rural EB-5 investment space.

Why Investors Continue to Choose EB5AN

EB5AN’s sustained success stems from its disciplined approach to project selection—focusing on investments that offer both strong immigration outcomes and robust financial protections for investors.

1. Investment Security

EB5AN’s rural projects provide either a senior mortgage on the development property or a loan repayment guaranty from a large U.S. real estate holdings company. Such loan security is rare among EB-5 investments.

2. Job Creation Security

EB5AN projects are typically already under construction at the time of offering, with a substantial portion of EB-5-eligible jobs already created. This structure provides investors with high confidence that their job-creation requirement will be met well before the I-829 stage.

3. Stable, Tangible Real Estate Assets

All rural EB5AN projects are based in real estate development—an inherently stable and tangible asset class offering predictable value and lower volatility compared with other investment types. These developments include single-family homes, townhomes, condos, hotels, and mixed-use resort communities.

4. 24 I-956F Approvals

EB5AN leads the industry with 24 I-956F approvals. Each project is structured carefully and submitted to USCIS for pre-approval before launch, giving investors confidence that the investment complies with all EB-5 program requirements and has a clear immigration approval path.

5. Transparency

With a variety of I-956F-approved EB-5 offerings, EB5AN enables investors to make informed decisions with side-by-side comparisons. EB5AN is committed to complete transparency—clearly outlining each project’s advantages, risks, and trade-offs. No project is perfect for every investor, and EB5AN emphasizes clarity so each investor can make a decision aligned with their individual priorities.

6. Comprehensive Guaranties

EB5AN offerings include multiple layers of protection. Typical guaranties may include:

- I-526E Approval Refund Guaranty – Return of investment capital if an investor’s I-526E petition is denied.

- Job Creation Guaranty – Assurance that sufficient qualifying jobs will be created for all investors.

- Loan Repayment Guaranty – Security from a large U.S. real estate holdings company that the EB-5 loan will be repaid upon maturity.

- Construction Completion Guaranty – Confidence that the project will be built to completion regardless of market fluctuations.

Current EB5AN Rural Offerings

EB5AN currently sponsors several rural TEA-designated EB-5 projects that qualify for priority processing and visa set-aside benefits under the RIA:

Bay Creek

Bay Creek is a rural senior EB-5 loan investment located on the Chesapeake Bay in Cape Charles, Virginia. The 741-acre master-planned community includes luxury homes, two championship golf courses, and miles of private beaches and a nature preserve. EB-5 funds are protected by a senior mortgage, job creation guaranty, and I-526E approval refund guaranty. With USCIS Form I-956F exemplar approval, investors benefit from priority processing and rural visa set-asides.

Rocky River

Located in Locust, North Carolina, Rocky River is a rural EB-5 loan investment that will create a 1,120-home Cresswind community, following Kolter’s 13 successful prior developments. Investors benefit from a loan repayment guaranty, job creation guaranty, and I-526E approval refund guaranty, providing exceptional financial and immigration security. With Form I-956F exemplar approval and the first I-526E petition approved in just 6.5 months for the prior fund, Rocky River offers priority rural processing, visa set-aside access, and a proven, USCIS-approved structure backed by EB5AN’s 100% project approval record.

Grand Park

Located in Fraser, Colorado, just over an hour from Denver, Grand Park is a premier rural EB-5 loan investment offering exceptional financial and immigration protections. The 264-acre master-planned community includes homes, apartments, lodging, and recreation, with construction already well underway. Over 200 EB-5 jobs have already been created. Investors benefit from priority I-526E processing, rural visa set-asides, and multiple safeguards including job creation, construction completion, and I-526E approval refund guaranties. Backed by EB5AN’s 100% USCIS project approval rate, Grand Park offers a secure, compliant path to U.S. residency.

Twin Lakes

Located in Hoschton, Georgia, Twin Lakes is a rural EB-5 loan investment developed by The Kolter Group, one of the largest private home builders in the United States. The 1,300-home master-planned community has already sold more than 800 homes and created thousands of EB-5 jobs. Investors benefit from multiple safeguards, including a loan repayment guaranty, job creation guaranty, and I-526E approval refund guaranty, each backed by a Kolter parent company. With multiple Form I-956F exemplar approvals and over 300 I-526E petition approvals across prior Twin Lakes funds, the project offers proven immigration success and financial security.

Each project combines the security of real estate collateral with the proven experience of EB5AN’s development partners and regional center team.

A Proven Track Record of Success

EB5AN’s leadership in the rural EB-5 market reflects its unwavering commitment to investor success, regulatory compliance, and transparency. With 600+ investor I-526E approvals and a 100% regional center project approval rate from USCIS, EB5AN continues to set the standard for quality and reliability in the EB-5 industry.

Learn More

To learn more about EB5AN’s current rural EB-5 projects, book a free call with our expert team today.