With the release of I-526E filing data for Q3 of the 2025 fiscal year, the EB-5 industry now has access to processing statistics from 2022 up to June 2025.

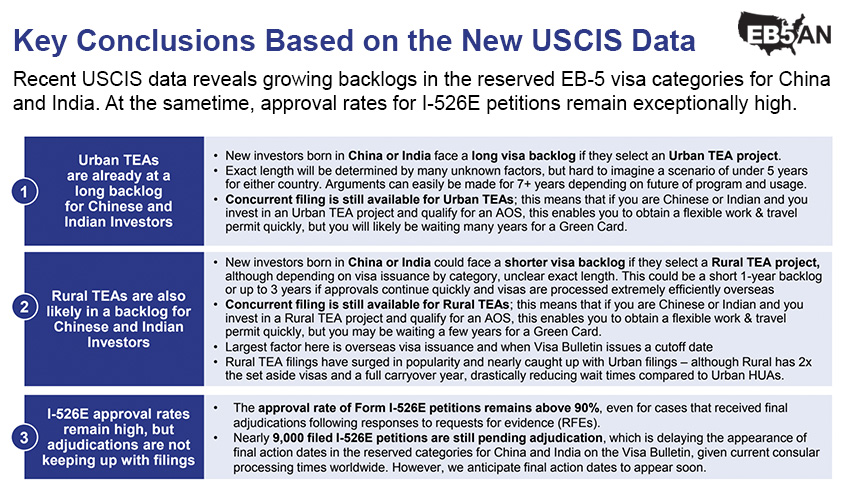

USCIS’s latest statistics provide crucial warnings for both current EB-5 investors and anyone considering the EB-5 path to a U.S. Green Card.

In 2025, the EB-5 program is seeing both exceptional demand, with frequent spikes in I-526E filings, as well as fast I-526E approvals for investors in rural projects. Rural priority processing is now a focal point of the EB-5 market, with investors receiving approvals in as little as 4-9 months.

At the same time, the steadily growing number of I-526E approvals and subsequent Green Card issuances are creating visa backlogs for the set-aside categories: rural and urban. China and India already have cutoff dates assigned for the unreserved categories, while Vietnam and Korea have faced retrogression in the past.

The current pace of rural and urban I-526E adjudications suggests that China and India will enter backlogs for both of these categories relatively soon. Once these backlogs begin, Chinese and Indian applicants will face significant delays for their Green Cards, and they will not be able to adjust their immigration status while living in the U.S.

How can EB-5 investors prepare for upcoming backlogs and minimize any delays—as well as minimize their financial and immigration risk?

EB5AN managing partners Sam Silverman and Mike Schoenfeld, along with senior VP Ahmed Khan, hosted a webinar analyzing the latest data and providing practical takeaways for EB-5 investors.

Notice the following key points discussed during the webinar:

- Given the pace of I-526E filings and adjudications in both the rural and urban set-asides, we expect both categories to enter a backlog. Chinese and Indian nationals will face significant delays before receiving their Green Cards.

- The rural backlog is likely to clear sooner. For India, the worst-case scenario could be an approximately six-year backlog, though it could be cleared in significantly less time. China will likely experience a longer backlog.

- For the urban category, both Indian and Chinese investors can expect a longer backlog. Urban is assigned only 10% of the yearly EB-5 visas, while rural is assigned 20%.

- Currently, investors in rural EB-5 projects are enjoying short approval times, as fast as 4-9 months. Both rural and urban investors who live in the U.S. can still adjust status and quickly obtain work and travel documents.

- If you are considering EB-5, now is the time to retain an immigration attorney and start gathering your source-of-funds documents. This will allow you to secure your immigration benefits before backlogs begin. Filing your I-526E petitions a few months earlier can result in getting Green Cards years faster.

Let’s now consider how the USCIS data supports these conclusions and what you can do to secure your immigration goals despite upcoming visa backlogs.

Select Webinar Highlights: USCIS EB-5 Visa I-526(+E) Statistics

Rural VS Non-Rural Filings by Country

Actual Data April 2022 to June 2025

Full Webinar: USCIS EB-5 Visa I-526(+E) Statistics

Rural VS Non-Rural Filings by Country

Actual Data April 2022 to June 2025

Download the Full Webinar Deck

Fast Rural Processing and Growing Demand for EB-5

A Look at EB-5 Filings By Country: Global Demand Shifting Toward Rural

Backlogs for Rural and Urban Set-Aside Categories: How Likely, and When Could They Begin?

I-526E Receipts, Approvals, and Pending

I-526E Approval Trends From EB5AN’s Internal Processing Data

Key Takeaways for EB-5 Investors

Fast Rural Processing and Growing Demand for EB-5

From April 2022 through June 2025, global EB-5 I-526E filings have risen steadily, with a clear shift toward rural projects. Early in the post-RIA period, rural filings represented only about one-quarter of all applications, but by mid-2025, they consistently accounted for more than half. The data show that since early 2024, rural filings have ranged from 48% to 61% of monthly totals, while urban filings have declined proportionally.

The main driver of this shift has been faster adjudication times for rural I-526Es. As confidence in the rural pathway grew, overall demand for EB-5 surged, even as urban, high-unemployment projects retained a smaller but steady share of the market—roughly one-third of total filings.

Two major filing spikes appear in the data. The first came in March 2024, just before the April 1 I-526E fee increase. That month saw 1,307 filings—by far the highest since the RIA was enacted—driven by investors rushing to file before the higher cost took effect. Demand dipped in the following months but stabilized at higher baseline levels than before the surge. The second catalyst was the February 25, 2025, “Gold Card” announcement, which caused a rapid uptick in March 2025 filings (844), followed by strong numbers in April (633) and May (567). As in the earlier surge, the pattern shows that EB-5 investors react quickly to major policy or regulatory events that threaten to raise costs or create uncertainty..

And while external factors temporarily inflate demand, the longer-term trend shows consistent growth. After the EB-5 Reform and Integrity Act (RIA) of 2022 reauthorized the EB-5 program and introduced set-aside visa categories, the overall number of filings climbed steadily year over year. Fiscal year 2023 ended with monthly volumes averaging around 250–300 filings, with rural shares near 30%. By fiscal year 2024, monthly totals rose closer to 400, and by fiscal year 2025, they regularly exceeded 500—sometimes approaching 600—with rural filings consistently accounting for more than 55%.

Another important factor is the grandfathering provision under the RIA. While the RIA reauthorized the regional center program through September 2027, the grandfathering clause—protecting filed investors from future lapses—only extends to petitions filed before September 30, 2026.

Investors who file before that date are guaranteed that their applications will continue to be processed even if the regional center program sunsets or undergoes further changes. Those filing after September 2026, however, face greater uncertainty: if Congress fails to re-extend protections, petitions filed between October 2026 and September 2027 could be left unprotected if the program lapses.

This deadline is now driving a new sense of urgency in the market. With just under a year remaining before the grandfathering window closes, the expectation is that investors will continue accelerating their filings throughout fiscal year 2026.

A Look at EB-5 Filings By Country: Global Demand Shifting Toward Rural

From April 2022 through June 2025, a total of 12,986 Form I-526E petitions were filed globally, with 49% in urban high-unemployment projects and 47% in rural projects. The remaining 4% fell into other categories. But the distribution varies sharply by country. China and India now both show a clear majority of rural filings—54% each—compared to earlier years when urban filings consistently dominated. For Chinese investors, 3,566 of 6,547 total filings were rural, while 2,866 were urban. Similarly, for India, 1,525 of 2,804 filings were rural and 1,195 urban.

This reversal in preference is driven by two main incentives: faster processing and larger visa availability. Rural EB-5 petitions are being approved far more quickly, whereas urban petitions often take two years or more. This difference has become decisive for investors from backlogged countries like China and India, where getting “in line” sooner can mean years saved in their wait for a Green Card. Priority processing for rural cases, coupled with the 20% visa set-aside, allows these investors to secure approvals before a backlog appears in the rural category.

Another reason for the shift is the structural advantage built into the RIA’s visa allocation rules. When a country reaches its annual limit under the 7% per-country cap, investors from that country can still access additional visas through the set-asides. The effect is similar to the H-1B lottery, where advanced-degree holders have two chances instead of one. Chinese and Indian investors understand that rural EB-5 projects effectively double their odds of timely Green Card issuance.

The rest of the world presents a different picture. Vietnam, South Korea, and Taiwan still show strong preferences for urban projects, with 70%, 82%, and 89% urban filings, respectively. These are agent-driven markets, where local migration agencies have traditionally favored large urban developments to promote to investors. However, even these countries are showing early signs of change: rural filings are rising as investors learn about the faster processing and reduced risk of backlog.

Outside these few markets, investors from other regions—Latin America, the Middle East, and parts of Europe and Canada—have embraced rural projects more quickly. In the “rest of world” category, rural filings already make up 36%, with 54% still urban and 10% in other categories. The broader trend shows that as word spreads about the short processing times and visa set-aside advantages, more investors globally are shifting to rural EB-5 projects, even those who traditionally favored urban projects.

In practice, a rural investor could potentially reach conditional Green Card status within a year, compared with multiple years for an urban investor.

Investors likely want to avoid upcoming backlogs as well. The data suggest that early-stage investors—those who filed during the first year and a half after the RIA—will likely receive approvals and visa issuances smoothly even in urban projects, because overall demand was low then. But newer investors, especially those filing in 2025 and beyond, will increasingly find the rural category the only fast path to a Green Card.

In analyzing the data, we should also consider how the EB-5 program is marketed in these various countries. In countries with established migration agency systems, urban projects are easier to market, often located in recognizable U.S. cities like New York or Miami. In contrast, investors working independently or through smaller advisory networks—common in Latin America and the Middle East—tend to make decisions based on immigration efficiency, leading to a higher rural share. This explains why non-agent-driven regions are adopting rural EB-5 faster, while Taiwan, South Korea, and Vietnam remain more urban-leaning despite their potential exposure to future backlogs.

Looking at the total data, the EB-5 landscape has reached near parity between rural and urban filings. Out of 12,986 total applications filed under the RIA, rural petitions now stand only slightly behind urban ones, but the data shows rural overtaking urban during 2025. The pattern matches the first chart’s trendline: over time, rural’s share has grown steadily month by month. As approvals continue arriving quickly for rural applicants, that momentum is likely to continue.

Backlogs for Rural and Urban Set-Aside Categories: How Likely, and When Could They Begin?

Since the RIA’s implementation in April 2022, USCIS has recorded 12,986 I-526E filings. China continues to dominate EB-5 demand, accounting for more than half of all filings, while India represents 22% and the rest of the world now accounts for an unprecedented 28%. This new level of participation from non-China/India countries is significant—it means that the overall visa pool available to all applicants, especially those from high-demand countries, will face greater competition going forward.

Of the total filings, 6,389 were in urban [or high-unemployment (HUA)] projects and 6,089 were in rural projects. Using a conservative assumption of two visas per I-526E filing to account for principal investors and family members, the total visa demand from post-RIA petitions is estimated at 26,000. That includes roughly 12,778 visas required for urban investors and 12,178 for rural investors. Because each fiscal year allocates only about 1,000 visas for HUA TEA and 2,000 for rural TEA (not including rollover visas from previous fiscal years), the volume of pending cases already exceeds the annual visa supply in both categories.

This indicates that multi-year backlogs are likely to begin for rural and urban, although the actual duration will depend on several factors—approval rates, family size, country caps, and how many unused visas roll forward each year. Current approval rates exceed 90%, which means nearly all filings will eventually require visas. Even at the conservative two-per-petition multiplier, the estimated rural and urban totals would each require six to seven full years of visa issuances to clear if demand stopped today.

However, not all investors will experience the backlogs equally. Country caps and the distribution of filings by nationality can affect the length of the backlog. For India, approximately 2,804 post-RIA applications have been filed. Assuming roughly 20% already approved, fewer than 2,500 petitions likely remain pending, or about 5,000 total visas when family members are included. With India’s annual 7% cap yielding about 1,000 EB-5 visas per year, the worst-case backlog for Indian applicants could be five to six years—or even less. This is far shorter than the decades-long estimates that have been circulating.

For China, the picture is less favorable. Chinese EB-5 investors make up roughly half of all post-RIA filings, on top of a substantial number of pre-RIA petitions still awaiting issuance. Those legacy cases occupy most of China’s unreserved visa capacity, leaving new investors dependent almost entirely on the rural and other set-aside categories for meaningful progress. Even with the 20% rural set-aside, the sheer volume of pending Chinese petitions suggests that a longer backlog is unavoidable and likely to appear first in the urban HUA category, followed later by rural once demand continues to grow.

The situation for the rest of the world differs again. Because no single country in that group exceeds the 7% cap, most rest-of-world investors will continue to have visas immediately available even as China and India approach their limits. But the rapid growth in filings from Latin America, the Middle East, and East Asia has narrowed that gap. The 28% share from rest-of-world is historically high, meaning that these investors are now drawing from the same overall pool of EB-5 visas that might otherwise have been available to China and India.

Our estimated visa demand assumes a consistent two-person multiplier per application, but historical USCIS data suggest closer to 2.6–2.7. If that higher ratio proves accurate, total post-RIA visa demand would exceed 30,000, extending the time needed to clear pending cases even further. Although incomplete issuance data for FY2025 make exact modeling difficult, USCIS has confirmed that only limited numbers of EB-5 visas were issued in 2023 and 2024, meaning most of this 25,000-plus demand remains pending.

And considering the unused visas left from the 2024 fiscal year, IIUSA, an EB-5 trade organization, estimates approximately 2,000 HUA TEA and 4,000 rural TEA visas still available for the current fiscal year.

The main takeaway from this data is that both urban and rural EB-5 categories are moving toward multi-year visa backlogs, with China already the most affected and India next in line. Rural applicants will likely have an advantage due to faster adjudication, double the visa allocation, and continued priority processing. For new investors deciding today, filing Form I-526E as soon as possible may be the only way to secure their immigration benefits before backlogs hit.

I-526E Receipts, Approvals, and Pending

Through Q3 of FY2025, USCIS had already received roughly 30% more I-526E filings than in all four quarters of FY2024, showing the sharpest annual growth since the RIA began. That increase indicates a strong surge of new investors entering the program over the past 12 months. The large number of new filings is expected to drive the next major wave of approvals and, shortly after, the first visible backlogs on the Visa Bulletin once green cards start being issued in volume.

With rural adjudications now moving faster than ever, many of these FY2025 applicants will be fully approved within the next year. Once those approvals convert into adjustment-of-status cases and consular issuances, total demand for available visas will quickly outpace the annual limits—particularly for China and India, where filings are already high. The Department of State will then have to impose backlogs to control the pace of green card issuance. When that happens, investors who filed their I-526Es earlier will have the advantage.

Approval rates remain high—around 94%—but the denial rate has, notably, grown to 6%. EB-5 denials have historically been low due to the small size of the industry and the experience of immigration attorneys specializing in EB-5. The recent increase reflects a shift in USCIS’s review standards. Adjudicators are likely becoming stricter about loans from regional center entities and other questionable source-of-funds practices.

I-526E Approval Trends From EB5AN’s Internal Processing Data

EB5AN’s investors have now received more than 600 I-526E approvals, making this one of the most transparent and closely tracked EB-5 approval datasets in the industry. The results show a clear and consistent downward trend in adjudication times for rural: approvals are coming faster each quarter. Among all recorded cases, more than 75% were approved in under 12 months, and over half were approved within just 6 to 9 months. Some of the most recent investors have received approvals in as little as 4 months, adding to EB5AN’s impeccable track record.

The data shows that most of the fastest approvals—those under one year—belong to rural filings such as Tamarack Resort, Twin Lakes Georgia, and Rocky River. High-unemployment urban projects, such as Saltaire St. Petersburg, show longer processing times, typically above a year. When plotted over time, the trend line of approval months drops steadily from late 2022 through mid-2025, confirming that USCIS has substantially increased adjudication speed for rural EB-5 investors. For new investors filing now, the data indicates a strong likelihood of approval within a single fiscal year, particularly for those investing in a rural TEA project.

EB5AN’s I-956F project approval record is just as successful. Since the RIA was enacted, our managed projects have achieved 22 Form I-956F approvals with zero denials. Over the trailing 12 months, the average approval time for EB5AN projects was just 3.8 months—significantly faster than the USCIS average of 5.2 months. The company’s last 17 I-956F approvals were all issued within six months, and several cleared in less than two.

Importantly, EB5AN’s data also dispels a persistent myth in the EB-5 market—that investors must wait for I-956F project approval before filing their I-526Es. Across our approvals, no measurable difference appears between investors who filed before versus after I-956F approval. Investors in high-quality projects—and with clean I-526E filings—receive approvals quickly regardless of the I-956F approval date.

For investors, the takeaway is: focus on project quality, not just the timing of I-956F approval.

Key Takeaways for EB-5 Investors

For investors currently considering EB-5, the data and recent processing trends show that time is of the essence—especially for Chinese and Indian nationals.

These two countries already show heavy demand in both urban and rural visa categories, and backlogs in the Visa Bulletin now seem to be all but certain. Filing before that occurs allows investors inside the United States to take advantage of concurrent filing—submitting both the I-526E petition and adjustment of status application at the same time. This provides immediate benefits: lawful status in the U.S., plus eligibility for work and travel permits while waiting for a Green Card.

Once a backlog appears, new investors will lose this option and have to remain in their current visa status or leave the U.S. while waiting for their petitions to move forward.

The difference between filing before or after a backlog begins could mean several years of waiting. For Indian and Chinese investors, EB-5 can allow them to remain in the U.S. with work and travel permits as they wait for their Green Cards. For many H-1B or L-1 visa holders facing limited options in other employment-based categories, EB-5 has become the most direct and predictable route to permanent residency.

While both urban and rural EB-5 categories will eventually face backlogs, the rural category will likely be the best option for those seeking a shorter wait. Rural TEA investors benefit from twice the annual visa allocation of urban investors and from priority processing. Even with growing demand, the larger supply of visas and the speed of adjudications mean that rural applicants are likely to advance more quickly once cutoff dates begin. Rural filings also benefit from rollover of unused visas.

At the same time, investors should recognize that nearly 9,000 filed petitions are still awaiting adjudication. As these approvals begin converting into visa usage, the first backlogs will appear, most likely beginning with urban categories. Once that happens, every new investor will be placed behind those already approved and waiting for visa numbers to become available. Acting before that point locks in a priority date and ensures access to concurrent filing benefits that could soon disappear.

For prospective EB-5 investors inside the U.S., now is the time to begin the filing process.

First, secure an immigration attorney. EB-5 attorneys and law firms are already reaching capacity as filing volumes surge. Working with counsel early ensures your case can move quickly once you select a project. Second, begin organizing your source of funds documentation. Bank records, tax returns, and currency-transfer approvals take time to assemble, and these often become the bottleneck before you’re ready to file your I-526E.

Third, select the project that fits your priorities—rural or urban—based on your immigration goals, tolerance for backlog risk, and preferred investment timeline.

If you have any questions about the EB-5 program or EB5AN’s projects, we invite you to schedule a free consultation today. This can be the crucial first step toward securing U.S. Green Cards for yourself and your family—before backlogs begin.