New data about the EB-5 program has recently become available. One of the most exciting aspects of this data is that it gives EB-5 investors better information to predict how long it will take them to obtain an EB-5 Green Card in a rural or urban EB-5 project.

The data reveals that the EB-5 industry is experiencing several new trends in Form I-526E filings. The first clear trend from the new data is that the number of Chinese and Indian investors choosing rural EB-5 projects is on the rise. Second, EB-5 investors who choose rural projects are enjoying significantly faster Form I-526E approval processing times. Third, demand for EB-5 visas has remained relatively steady after the April 1, 2024, fee increase for Form I-526E. The overall conclusion from the new data is that a multi-year backlog already exists for new Chinese and Indian EB-5 investors who invest in urban high-unemployment projects.

As you read this article or any other data analysis, you should always consider the perspective of the author, their experience in analyzing data, and the supporting evidence they offer for any takeaways. As a regional center operator, we have both urban high-unemployment and rural deals available. Each category has different pros and cons. We think excellent projects can be offered from either category—and our projects in these categories are some of the strongest in the market.

So, instead of trying to convince you of the superiority of one project type over another, our intention is to help you understand the trends in the market and arrive at more informed conclusions for yourself. Our analysis combines five different data sources, two of which are proprietary, to give you the information you need to move forward with confidence.

Form I-526E Filing and Approval Trend Summary

USCIS recently released Form I-526E receipt data from FY2022 through July 2024 in response to Freedom of Information Act (FOIA) requests. Additionally, more detailed data through April 18, 2024, is available through a different FOIA request.

We want to start by thanking the groups that have worked to obtain the data that is examined in this article. The data shows not only total Form I-526E filings but country-specific numbers for China and India, and it distinguishes between rural and urban submissions. IIUSA has also summarized recent data from leading regional center operators. And now, EB5AN has exclusively obtained EB-5 investor funding data from Customers Bank, a leading EB-5 escrow agent.

EB-5 investors and EB-5 industry professionals all benefit from greater access to this recent Form I-526E data. These statistics answer the following key questions:

- Which countries are responsible for the most Form I-526E filings under the Reform and Integrity Act of 2022 (RIA) and in FY2024?

- Could the urban set-aside visa category enter a backlog?

- Are EB-5 investors favoring rural or urban projects under the RIA?

- How much faster are rural Form I-526E petitions being processed than urban filings?

- Did EB-5 demand significantly decline after the April 1 filing fee increase?

Specifically, the new data reveals three major trends.

More rural projects. Since Congress passed the RIA just over two years ago, rural projects have grown in popularity. This growth is due largely to the RIA’s incentives for investing in rural projects, especially for investors from countries with high EB-5 visa demand like China and India. Up until the most recent data, the industry saw a majority of investors choosing urban high-unemployment deals at a rate of 1.5 to 1. The trend has shifted toward more of an even balance of rural filings.

Faster rural Form I-526E processing. New, reliable statistics for rural Form I-526E approvals under the RIA show a clear difference between rural and urban processing times. One of the largest takeaways is that over 90% of urban high-unemployment Form I-526E petitions are still pending. With so many petitions pending, the current processing times for urban filings are more anecdotal and are not useful in accurately predicting future processing times.

Steady EB-5 demand. Additionally, the data shows an overall trend of steady demand for EB-5 visas. The fee increase pulled a large number of Form I-526E filings into a single quarter—but the amount of new investor demand (as tracked by each investor’s first wire into escrow) remained much more steady than USCIS filing data shows.

EB5AN’s latest webinar analyzed the recent Form I-526E filing data from various sources. It featured EB5AN’s managing partners Sam Silverman and Mike Schoenfeld as well as EB5AN vice president Ahmed Khan.

In the webinar, EB5AN leveraged exclusive EB-5 investor funding data from Customers Bank, one of the leading escrow agents in the EB-5 space. The EB5AN team was joined by Daniel Topple, a senior vice president in the private and commercial banking division of Customers Bank.

The following are the key takeaways from our analysis of Form I-526E filing and investor funding trends under the RIA:

- China and India dominate post-RIA filings. Approximately 71% of all Form I-526E filings after the RIA was passed (March 2022 through July 2024) have come from China (~51%) and India (~20%) alone.

- Chinese and Indian urban investors likely face a backlog. The high volume of Indian and Chinese investors who have invested in urban high-unemployment projects (as of July 2024) suggests a many-year backlog for new Indian and Chinese investors. While various assumptions can be made, reasonable assumptions project a five-year or longer timeline to receive a Green Card if filing in this category.

- Demand for rural projects is growing. Overall, the majority of post-RIA EB-5 investors have invested in urban projects. However, the data show a market trend of growing demand for rural projects. This clear shift suggests that a roughly 50/50 demand for urban and rural projects should materialize in the second half of FY2024.

- USCIS is clearly prioritizing rural Form I-526E petitions. Once all pending Form I-526E petitions are adjudicated, we believe at least a 12- to 18-month difference will exist in processing times between investors who chose rural rather than urban projects.

- Overall demand for EB-5 appears steady. Although Form I-526E filings appeared to decline 90% in Q3 FY2024 after the April 1 fee increase based on the USCIS published data, the new investor funding data from Customers Bank tells a different story. We believe that EB-5 demand was and will continue to be smoother than the Form I-526E receipt charts show. This decline was caused by a rush of filings by a certain date for investors whose petitions had been in progress for many months, not by an actual dip in demand for EB-5 visas.

Following are some highlights from our recent webinar:

Following is the full recording of the recent webinar:

Data Sources

EB5AN’s Data-Driven, Unbiased Methodology and Transparency

China and India Dominate Form I-526E Filings Under the RIA

The Urban Set-Aside Visa Category Will Enter a Backlog—But the Timing of This Is Uncertain

Steadily Growing Demand for Rural EB-5 Projects

USCIS Is Prioritizing Rural Form I-526E Petition Approval over Urban Filings

Demand for EB-5 Immigration Appears Steady

Future Demand Projections for EB-5 Immigration

Data Sources

The data analyzed in this article is taken from six primary sources:

- FOIA data obtained by WR Immigration, an immigration law firm.

- FOIA data obtained by Meyer Law, another immigration law firm.

- Statistics from major regional center operators compiled by Invest in the USA (IIUSA), an EB-5 trade organization.

- EB-5 investor funding data from Customers Bank.

- EB5AN’s proprietary Form I-526E and Form I-956F data.

- USCIS official published data.

Download Webinar PowerPoint Slides

EB5AN’s Data-Driven, Unbiased Methodology and Transparency

EB5AN believes that investors deserve unbiased analysis and transparency. That means sharing both our conclusions and the data we look at to reach our conclusions.

Our team appreciates thoughtful debate and discussions based on complex data. EB5AN’s founders, Sam and Mike, are Boston Consulting Group (BCG) alumni, and our team members come from backgrounds where data drives decision making. At BCG, Sam and Mike reviewed hundreds of complex and incomplete datasets for Fortune 500 companies, providing advice to senior executives based on their careful analysis.

Unlike some of the other analysis we have seen in the EB-5 industry, we will not publish one-sided analysis and from cherry-picking subsets of data to promote our projects. Earlier this year, for example, we were one of the first in the EB-5 industry to report that the urban set-aside visa category was likely facing backlogs for some investors. While one might assume we shared this information despite having urban projects, the truth is we did so because we have urban projects.

At EB5AN, we believe it is more important to give investors all the information they need to make well-informed decisions rather than to convince them to invest in a specific project or type of project that may not be the right fit.

Unfortunately, some in the industry publish information based on what benefits them most—not based on what investors need to know. Some choose not to publish information based on a fear of upsetting others in the industry. We cannot blame various groups for not putting certain conclusions in writing when it will upset their regional center clients. This is understandable when a group has a diverse set of self-interested stakeholders.

We, however, are willing to publish our overall conclusions—even when those conclusions may not be beneficial to certain EB-5 projects we sponsor.

With complicated information on submissions and processing times, it is critical to look at the data as a whole. Some smaller pieces of analysis may present only specific subsets of the data, which can lead to a simple conclusion that is not supported when looking at all of the data. Trends in rural Form I-526E processing times, for example, cannot be looked at in isolation. To be meaningful, they need to be compared to urban Form I-526E processing times. More importantly, viewing processing trends in context with filing dates and shifting demand allows for a more accurate triangulation of the most likely future trends.

At EB5AN, we strive to maintain the highest degree of transparency when we publish data or analysis. We never selectively present data to make our projects look better: it goes against best practices and does nothing to help EB-5 investors or the EB-5 industry.

EB5AN is committed to providing unbiased analysis that looks at all available data because we are not selling a single product being developed by us. We offer a menu of projects based on investors’ current needs. We understand that EB-5 investment is no longer one size fits all—a project that is a poor fit for one investor is a great fit for another.

With this context out of the way, let’s move on to our analysis. We would be happy to discuss any of this analysis in detail, the thought process behind it, our key assumptions, and the unknowns—just reach out through the link that appears at the end of this article.

China and India Dominate Form I-526E Filings Under the RIA

China and India have continued to dominate the EB-5 market from FY2022 up to FY2024 (July 2024). Together, EB-5 investors from these nations account for approximately 71% of all Form I-526E filings during this period.

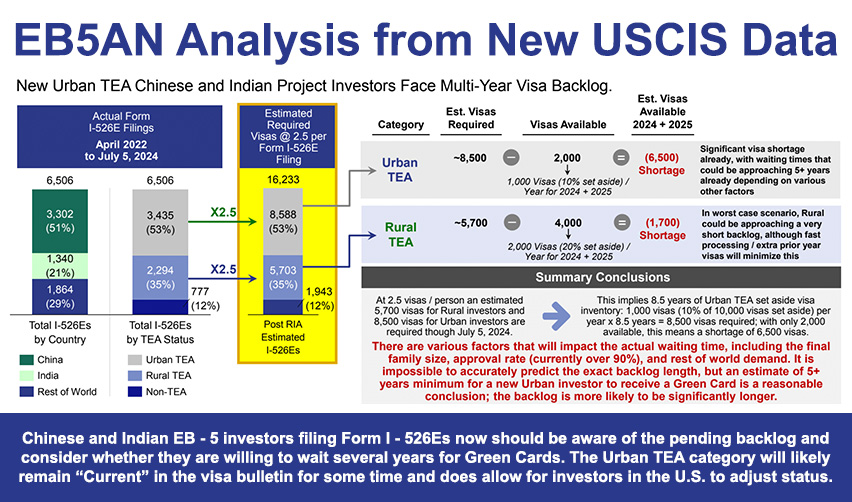

From FY2022 to July 2024, a total of 6,506 Form I-526E petitions were filed globally. Chinese investors filed 3,302 Form I-526E petitions (~51% of total filings) during this period, while Indian investors filed 1,340 Form I-526E petitions (~20% of total filings).

Investors from all other countries—referred to in the data as rest of world (ROW)—filed 1,864 Form I-526E petitions. These account for only about 28% of the total submissions.

Figure 1 includes Form I-526E submissions in unreserved or unknown categories.

Both China and India experienced a spike in Form I-526E submissions in FY2023 after low filing volumes in FY2022. The reauthorization of the regional center program in late FY2022 likely contributed to this trend.

Similarly, both countries have already seen more filings so far in FY2024 than in all of FY2023.

Figures 2 and 3 do not consider unreserved and unknown filings.

Based on this filing data, we can see a shift toward rural filings for both China and India. Overall, there are still more pending Form I-526E petitions for urban high-unemployment projects than rural for both China and India, but in the recent fiscal year, this is shifting more toward a 50/50 balance.

The Urban Set-Aside Visa Category Will Enter a Backlog—But the Timing of This Is Uncertain

As we will examine below, both the Chinese and Indian markets are seeing increased demand for rural EB-5 projects. Still, since FY2022 to July 2024, most EB-5 investors overall have chosen urban projects. Specifically, investors from both China and India have more pending Form I-526E petitions for urban than for rural.

As Figure 1, above, illustrates, for every 10 EB-5 investors, approximately 5 have chosen urban projects and 3.5 have chosen rural projects during this period.

A total of 3,435 urban Form I-526E petitions were filed. Of these, 3,302 were from China, 1340 were from India, and 1,864 were from ROW.

What could the significant volume of urban Form I-526E filings under the RIA mean for Chinese and Indian investors?

Only 10,000 EB-5 visas are available each year. Each country is allocated a 7% share of all EB-5 visas. If the number of people from a given nation who apply for EB-5 visas is greater than the number of visas allotted to that nation, a visa backlog occurs. In this event, EB-5 investors will have to wait to immigrate until more visas are made available. Currently, China and India face long EB-5 visa backlogs in the unreserved visa category.

Under the RIA, investors may be able to avoid such backlogs by investing in projects that are in rural or urban targeted employment areas (TEAs). By investing in a project in a TEA, an EB-5 investor qualifies for a set-aside urban or rural visa. These special set-aside visas are not affected by backlogs in the unreserved visa category. As a result, a set-aside visa may allow an investor from an otherwise backlogged country to avoid months or years of processing delays.

Both China and India have historically had a substantial backlog of EB-5 petitions in the unreserved category from pre-RIA EB-5 demand. As a result, new EB-5 investors from these countries will benefit from the set-aside categories.

However, each set-aside category also has a limited supply of visas available each fiscal year. If a set-aside category runs out of available visas and enters a backlog, investors applying for visas in the backlogged category may not be able to avoid additional delays.

The urban category receives only 10% of the total yearly supply of EB-5 visas. The rural category, however, receives 20%. In other words, the urban category has half the supply of EB-5 visas compared to the rural category. At the same time, the data shows significantly more urban than rural Form I-526E petitions have been filed.

As shown in Figure 4, EB5AN’s projections based on the latest data show that the urban category could soon face an extended backlog. Should this occur, Chinese and Indian investors in urban projects may have to wait for multiple years before they receive their U.S. Green Cards.

Assuming that each Form I-526E filing will require 2.5 visas (for the investor and dependent family members), we estimate that approximately 8,500 visas will be needed to meet the demand for urban set-aside visas through FY2024 and FY2025. This anticipates a 100% approval rate (the current Form I-526E approval rate is above 90%) and 2.5 visas per application. This could be seen as a “worst-case” scenario based on historical averages, but the number is in line with reality.

Urban Visa Usage

With 10% of the yearly total supply of 10,000 EB-5 visas, the urban set-aside visa category is expected to have an annual supply of 1,000 reserved visas. The number of available urban set-aside visas for FY2024 and FY2025, then, should be 2,000.

A supply of only 2,000 visas and demand for 8,500 visas leaves the urban category with a shortage of 6,500 visas.

This shortage of 6,500 urban visas would imply a backlog of at least five years for investors from countries with high demand for EB-5 visas. Depending on factors such as the actual number of dependent family members on each application and the Form I-526E approval rate, the backlog may be much longer.

This issue is further compounded by other factors. For example, in the unreserved category 10,000+ pre-RIA investors from China still need visas issued. This pre-RIA demand is critical to keep in mind for high-demand countries like China and India.

For all ROW countries, access to set-aside visas is not critical. Even for medium-demand countries like Taiwan, South Korea, and Vietnam, which may exceed their 7% allocation of urban visas, investors from those countries still have their 7% share of unreserved visas, which eliminates the potential of a significant backlog.

Rural Visa Usage

In contrast to the situation with urban EB-5 visas, we estimate that, under what we see as the worst-case scenario, only 5,700 visas are needed for the rural category in FY2024 and FY2025. With 20% of the yearly supply of EB-5 visas, the rural category will have about 4,000 visas available for that period.

With a potential shortage, then, of 1,700 visas, certain investors in the rural category could also face a backlog, but it would likely be brief. Any potential backlog would completely depend on the processing times of Form I-526E petitions, the actual issuance of the visas, and the rollover amounts. Even in the worst case, this is less than a year’s worth of visa set-asides.

Chinese and Indian nationals who are planning to make EB-5 investments should consider this data when choosing which project to invest in.

Even though the urban category currently allows investors living in the United States to adjust their immigration status quickly, the backlog could mean that investors will have to wait for multiple additional years to obtain their Green Cards. For some investors, this is a completely acceptable outcome.

As long as there is full transparency, we support every investor’s right to decide which project is the best choice for him or her. There can be various benefits for urban projects versus rural projects that may outweigh a multi-year wait time for a Green Card, especially if an investor can obtain employment authorization documentation and an advanced parole.

Nonetheless, the overarching conclusion here is that the rural category is the safest option for Chinese and Indian investors who want to receive their U.S. Green Cards as quickly as possible.

Steadily Growing Demand for Rural EB-5 Projects

Demand for rural EB-5 projects has been growing steadily under the RIA, both in absolute terms and as a percentage of demand versus high-unemployment urban projects.

Figure 5, above, which does not consider unreserved and unknown Form I-526E filings, shows that 32.8% of all Form I-526E filings in FY2023 were rural. In contrast, 48.1% of filings in FY2024 (up to July 2024) were rural. We expect rural projects will continue to see more demand through the remainder of the fiscal year.

Country-specific data in Figures 2 and 3, above, show that China and India are the main drivers behind the demand for rural projects. China’s yearly rural filings have increased from only 35.3% in FY2022 to 55.2% so far in FY2024. Under the RIA, 48.8% of Chinese investors have chosen rural projects. Similarly, India’s yearly rural filings increased from 30.3% in FY2022 to 49.2% in FY2024. Thus 40.4% of Indian investors have chosen rural projects under the RIA.

The EB-5 industry is rapidly nearing a 50/50 demand for rural and urban projects. Chinese and Indian investors have a clear incentive to invest in rural projects to avoid their visa backlogs, but ROW investors can also benefit from rural priority processing.

USCIS Is Prioritizing Rural Form I-526E Petition Approval over Urban Filings

Over the two years since the RIA was signed into law, a reliable body of data for rural Form I-526E approvals has formed. It has now become commonplace across the EB-5 industry for rural Form I-526E petitions to be processed in 12 months or less.

Below we will analyze the IIUSA industry data as well as our internal data (which was part of the IIUSA data).

Figures 6, 7, and 8 illustrate the significantly faster processing times for rural filings of both Form I-526E and Form I-956F project petitions.

In Figure 6, above, the USCIS data indicates a “normal processing range” of 4 to 15 months for Form I-956F petitions and 6 to 15 months for Form I-526E petitions. Form I-956F petitions are processed within an average of 8 months, while Form I-526E filings are processed in an average of only 10 months.

Additionally, Figure 7 illustrates that roughly 95% of rural Form I-526E filings have been approved within 15 months. By contrast, only about 55% of urban filings have been approved in this time frame.

Figure 8 contrasts the average processing times of rural and urban Form I-526E filings, showing an approximately four-month difference in favor of rural.

Even though this data shows that rural filings are processed significantly faster, it still understates the extent to which USCIS is prioritizing rural petitions. The current data for urban Form I-526E filings is misleading because the vast majority—approximately 92%—of urban filings under the RIA are still pending.

EB5AN’s analysis based on internal data and IIUSA data concludes that the following dynamic is at play. Immediately after the RIA was passed, many urban high-unemployment projects were ready to accept investors. The data shows that Form I-526E filings in the fiscal year that followed the passage of the RIA was 72% urban versus 27% rural—nearly three to one. A vast majority of the urban project approvals came from this initial burst in filings. EB5AN’s internal data reveals a crucial point: only those urban filings from the early part of the post-RIA burst have been adjudicated. The further a filing is from this initial rush, the longer the approval timeline extends.

EB5AN’s conclusion is that the aggregate processing data for urban submissions and approval timelines does not accurately reflect USCIS’s Form I-526E processing speeds under the RIA for new investors in urban high-unemployment projects. And without any changes in current processing timelines, we conclude that the difference in approval times on average between urban and rural applications will continue to grow.

While this is the conclusion today, various factors could change this. The simplest would be that as USCIS works their way through the backlog of pre-RIA Form I-526E filings, their capacity to process new urban Form I-526E filings could increase.

In Figure 9, below, EB5AN’s data for EB5AN rural and urban projects shows a 10-month difference between rural and urban Form I-526E adjudications. But once again, this is not the full story since very few urban applications have been approved. On the other hand, 100+ rural Form I-526E petitions have been approved across three rural Form I-956F–approved projects, as shown in Figure 10.

Once all pending Form I-526E petitions are adjudicated, we believe a difference in processing times of at least 12 to 18 months will arise between rural and urban investors. Since we believe in full transparency, we are willing to put this projection out there today. We are simply extrapolating the data and will defend this conclusion with data.

Demand for EB-5 Immigration Appears Steady

On April 1, 2024, USCIS significantly raised the filing fee for Form I-526E. Leading up to this date, the EB-5 industry saw a rush—and then a decline—in new Form I-526E filings. At first glance, the published USCIS data indicates an approximately 90% drop in Form I-526E filings from Q2 to Q3 of FY2024 due to the fee hike.

However, a different metric and more up-to-date statistics tell a different story.

EB5AN has gained exclusive access to EB-5 investor funding data through July 2024 from Customers Bank. Customers Bank is one of the most in-demand escrow agents in the EB-5 industry, representing roughly 20% of the EB-5 market. As a result, their EB-5 investor funding data is a reliable indicator of overall industry trends.

In fact, this EB-5 investor funding data is a leading indicator of USCIS statistics. EB-5 investors typically transfer their funds into escrow three months or more before filing their Form I-526E with USCIS. Using both sources provides a more updated picture of how many investors are currently starting the EB-5 process than the USCIS data alone.

In Figure 12, the published USCIS data indicates a 90% drop in Form I-526E filings from Q3 to Q4 of FY2024. However, the data from Customers Bank shows a decrease of only 33% in EB-5 funding activity.

In sum, this funding data suggests that the drop in Form I-526E filings was caused by many investors rushing to submit their petitions before the fee hike. The drop was not likely due to a 90% decline in demand for EB-5 visas.

Future Demand Projections for EB-5 Immigration

Through the RIA, EB-5 investors—especially Chinese and Indian nationals—have access to a faster path to U.S. Green Cards than was previously available. Likely due to these regulatory changes, Form I-526E filing data by fiscal year shows that the EB-5 program has rebounded since FY2022.

Even though the EB-5 program has not reached the demand levels seen in the peak years of 2014–2016, Form I-526E filings, especially in rural projects, are likely to continue to increase under the RIA.

For more information on the current trends in the EB-5 industry—and what this means for investors—schedule a free consultation with EB5AN.