The EB-5 Immigrant Investor Program is one of the fastest and most attractive ways for foreign investors to achieve permanent residency status in the United States, for both themselves and their immediate family members. However, the path to permanent residency is long and complex. Investing with experienced EB-5 investment partners who provide trusted advice can ensure a smoother journey and help investors avoid many pitfalls that could hinder or halt their EB5 investment journey.

Regional Centers

Most foreign investors choose to make their EB-5 investment through an EB-5 regional center. Regional centers have extensive experience with EB-5 investments and are well acquainted with the rigorous adjudication process to which United States Citizenship and Immigration Services (USCIS) subjects investors. Well-established regional centers can eliminate headaches and stress for EB-5 investment petitioners as they navigate USCIS compliance and petition submission issues. That being said, there are also some regional centers in the EB-5 investment world that are not reliable and working in bad faith. It is essential for investors to learn the distinguish these from the reputable EB-5 regional centers.

Preapproved Regional Center Projects

Many EB-5 investment participants searching for the right project will find regional centers touting pre-approved EB-5 projects. However, pre-approval does not mean a project is somehow more preferred by USCIS than another, nor does it mean that the path to immigration is guaranteed to be successful. All projects are subject to the same intensive scrutiny by USCIS and are evaluated and approved under identical guidelines. “Pre-approval” is a marketing tactic.

Pre-approved EB-5 projects are simply EB-5 projects whose I-924 petitions have been approved by USCIS. This designation is known as exemplar status. But I-924 petitions are, essentially, nothing more than a preliminary business plan. Regional centers that market their I-924 exemplar status as pre-approved are not necessarily to be distrusted, as long as they communicate the truth of matter early. But regional centers that withhold the truth from investors in their initial inquiry are best to be avoided.

What Is Deference?

An EB5 investment project must submit its business plan to USCIS in an I-924 petition packet, whereupon USCIS must confirm that the plan meets the EB-5 investment program before an I-526 petition can be submitted. If the project uses the same business plan and documentation in their I-526 petition, USCIS provides “deference”, simply acknowledging their previous evaluation to cut down on the amount of time and resources the agency must spend in its evaluation.

What does this mean for an individual EB5 investment participant? If an EB-5 investor invests in a regional center project that has deference, USCIS does not need to review the business plan portion of the investor’s I-526 petition. USCIS can simply review the investor’s personal information and source-of-funds verification. However, deference does not guarantee the success an applicant’s submission.

When Business Plans Change

A project having I-924 exemplar status simply means the project was “approvable” at the date of its original filing. Processing I-924 petitions can take several years, and EB-5 projects sometimes change aspects of their business plans after they have received I-924 approval. Portions of a project’s I-924 petition could become invalid by the time an individual investor files their I-526 petition.

U.S. regulations and policies change frequently in today’s political climate. For instance, in November 2019, changes in U.S. immigration law brought regulatory reforms to the EB-5 visa investment program. Regional center projects preapproved prior to November 2019 had to change their business plans before receiving final USCIS project approval to meet the new regulations. Any regional center using an outdated I-924 approval that still promises investors an expedited process without disclosing the risks is not to be trusted.

Risky Business

It is important for EB5 investment participants to know the facts before signing on to an older project with exemplar status and to ask the right questions to ensure the project meets the latest compliance requirements. Due diligence on the part of investors and their immigration attorneys is essential to ensure investors and their eligible family members receive green cards and a return on their investment.

Project partners who withhold information about risk present ethical and trust dilemmas with their investors and can quickly run into trouble with the U.S. government, as such lack of transparency is legally unacceptable. EB5 investment participants should make sure their project partners disclose any such risks to compliance of their own volition, even if the investor uncovers problems on their own.

EB5AN: The Safe Choice

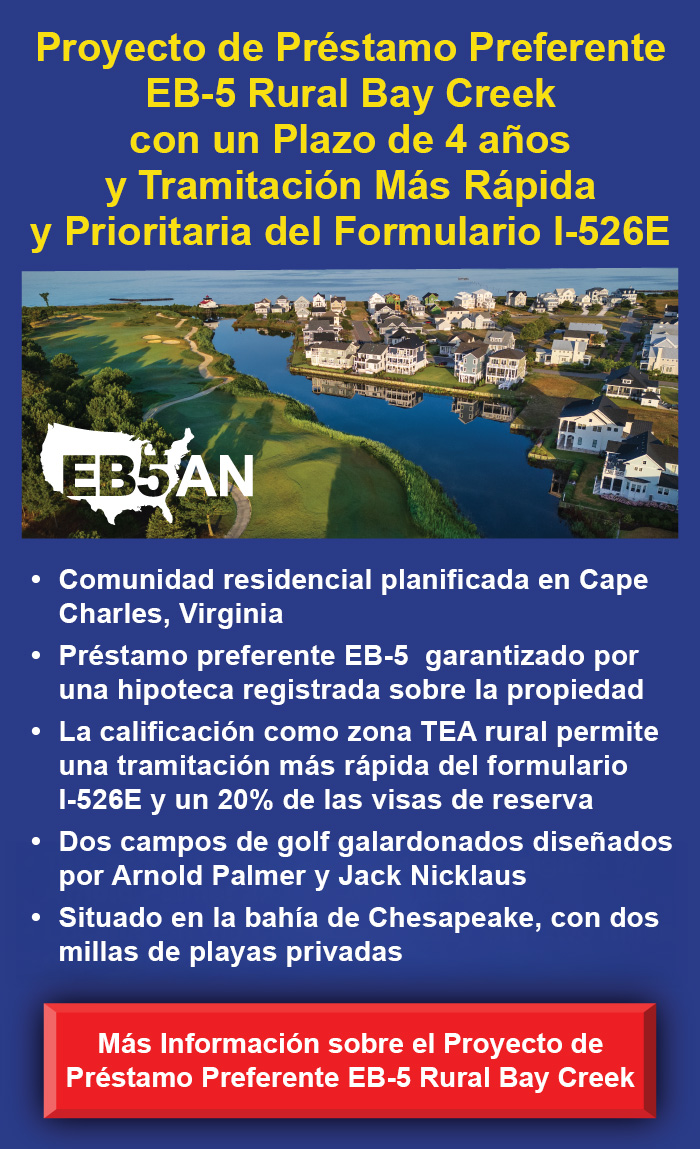

EB-5 Affiliate Network, a leader in the EB-5 investment industry, maintains a 100% approval rate with USCIS, due largely to the high level of transparency at which its partners operate. EB5AN works with all governing bodies of the residency-by-investment world, operates 14 trusted EB-5 regional centers across 20 U.S. states, and counts more than 1,800 foreign investors from more than 60 countries as clients.

EB5AN even gives away a plethora invaluable resources on the EB5 investment process for free, including a risk assessment questionnaire, an EB-5 job creation calculator, a massive and ever-growing blog full of advice and news on EB-5, and a national map of all targeted employment areas (TEAs) that is always up to date.

With experience in securities law, tax law, immigration law, investment evaluation, and more, the team at EB5AN is ready to answer any questions an investor may have about the EB-5 investment process. Reach out to EB5AN and begin your EB-5 investment journey today.