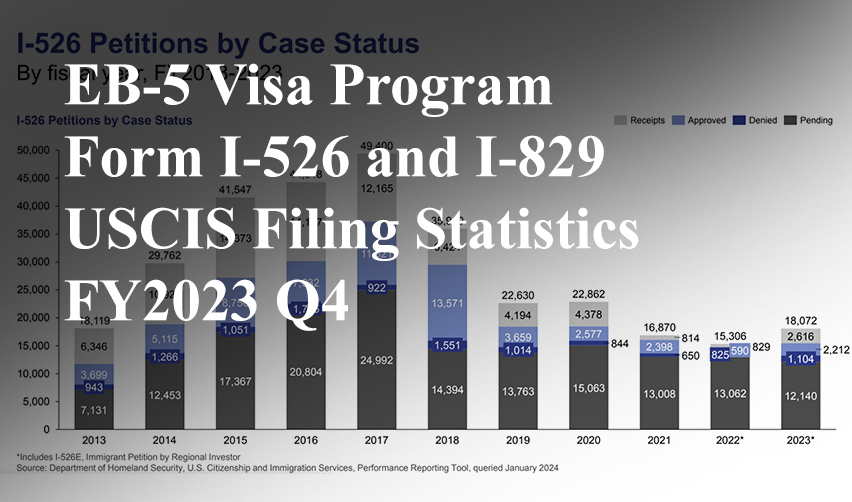

United States Citizenship and Immigration Services (USCIS) has released EB-5 petition processing statistics for FY2023 Q4. This new data includes Q4 (July through October 2023) and also the entire FY2023.

The USCIS data includes processing statistics for Form I-526 and Form I-829.

Form I-526 is the initial petition for a conditional Green Card. EB-5 applicants file Form I-526 after making their investments.

There are two distinct versions of Form I-526.

EB-5 investors in regional center-sponsored projects file Form I-526E, Immigrant Petition by Regional Center Investor. Those who invest directly in an EB-5 enterprise file Form I-526, Immigrant Petition by Standalone Investor.

Form I-829 is filed at the end of an investor’s two-year residency period to remove the conditions on their Green Card.

The processing statistics for FY2023 show a continuous strong demand for the EB-5 visa, with 2,431 total filings of Form I-526E and 185 new filings of Form I-526 in FY2023.

In contrast, the entirety of FY2022 saw 829 I-526 filings. There were only 814 I-526 filings in FY2021.

FY2023’s I-526 and I-526E total filings already represent a 316% growth rate from FY2022.

This renewed demand for EB-5 immigration may be attributed to the additional benefits for EB-5 investors under the EB-5 Reform and Integrity Act of 2022 (the “RIA”).

Under the RIA, EB-5 applicants from China and India can avoid their country’s processing backlog through the new arrangement for set-aside visas. In addition, priority processing for investors in rural EB-5 projects has allowed several investors to receive Form I-526E approval within 12 months—a significantly faster processing timeframe.

EB-5 investors who hold non-immigrant U.S. visas also benefit from concurrent filing. This allows them to quickly change their immigration status and remain in the United States regardless of their employment status or other limitations on their former visa.

Concurrent filing also allows EB-5 investors to quickly obtain an employment authorization document (EAD).

Download EB5AN’s analysis slides for a comprehensive breakdown of the FY2023 data and continue reading for detailed analysis and important points.

Note: As sometimes occurs in USCIS statistics, there are discrepancies between the quarterly and yearly processing data.

Download EB5AN Analysis Slides on I-526 and I-829 Processing Statistics

I-526 Processing Data

I-829 Processing Data

Form I-526 and Form I-829 Processing Data Comparison

Predicting Future Trends in EB-5 Petition Processing

I-526 Processing Data

Receipts

FY2023 saw a total 2,616 new I-526 and I-526E receipts. This represents a 316% increase, up from 829 filings in the previous fiscal year.

While the quarterly average of new I-526 filings was only 207 in FY2022, the quarterly average in FY2023 is 654.

USCIS has also released separate receipt statistics for the I-526 and I-526E petitions for FY2023.

With a quarterly average of only 46 I-526 petition receipts this fiscal year, the regional center program with a quarterly average of 625.5 I-526E petition receipts remains by far the most popular investment vehicle for EB-5 applicants

Approvals and Denials

With 2,212 I-526 and I-526E approvals in FY2023, I-526 approvals increased by 374.92% from the previous fiscal year. There are 63 recorded I-526E petitions approved this fourth quarter of FY2023.

Interestingly, the quarterly average of I-526 approvals was only 147.25 in FY2022. The higher volume of I-526 filings in the 2022 and 2023 fiscal years seems to have already been reflected in increasing I-526 approvals.

Despite the higher volume of I-526 and I-526E receipts, there were only 1,104 I-526 denials in FY2023. The previous fiscal year saw 825 denials.

Analyzing I-526 Processing Trends

The significant increase of I-526 and I-526E filings in FY2023, particularly in this latest quarter, likely reflects bolstered demand under the RIA.

While most EB-5 markets have likely seen increased demand thanks to the RIA’s new immigration benefits, the Chinese EB-5 industry has seen especially rapid growth in FY2023.

The new set-aside visa categories can allow Chinese investors to avoid their country’s large backlog of EB-5 petitions and potentially gain I-526 approval years earlier than otherwise possible.

As of December 6, 2023, the USCIS Check Case Processing Times page reports that 80% of Chinese I-526 petitions are adjudicated within 85.5 months—over 7 years.

In contrast, Chinese investors can potentially get I-526 approvals within 12 months by investing in a rural project.

In a recent article in The Wire China, EB5AN managing partner Sam Silverman noted that “the new [set-aside visa] categories present a once-in-thirty-year opportunity. For the last five years, there was minimal demand [from Chinese investors]. Now, it is bouncing back.”

However, the set-aside visas make up only 32% of the yearly EB-5 visa supply. After enough I-526 petitions are filed in the set-aside visa categories, the set-aside categories will also become oversubscribed.

Once this occurs, there may be a decrease in new I-526 filings from China and India. Both countries are currently backlogged.

Until then, the higher volume of I-526 filings may provide USCIS with additional resources that can be allocated to processing EB-5 petitions.

The agency has stated that 95% of its revenue comes from filing fees. The filing fee for Form I-526 (including the I-526E petition) is currently $3,675. The filing fee for Form I-829 is $3,750.

The 56. 90% quarterly increase in I-526 approvals may partly be due to the rural petitions filed within the last 12 months and approved faster under the RIA’s priority processing.

In total, 185 I-526 and 2,431 I-526E petitions were filed in FY2023, and the backlog of pending petitions decreased by 7% at the fiscal year level.

I-829 Processing Data

I-829 Receipts

1,170 I-829 petitions were filed in FY2023. This represents a 8% decrease from the 1,270 filings in the previous fiscal year.

Form I-829 is filed after an EB-5 investor’s two-year conditional residency. Given that Form I-526 can take multiple years to be adjudicated, it may be several years until the upturn in I-526 filings is reflected in I-829 receipt volumes.

I-829 Approvals and Denials

1,784 I-829 petitions were approved in FY2023, and 256 were denied.

I-829 Petition Summary

9,989 I-829 petitions were pending by the end of FY2023. This represents a decrease of 10% from the 11,150 I-829 pending petitions in FY2022.

USCIS has not yet achieved a significant reduction of the I-829 backlog despite a surge in EB-5 demand following the COVID-19 pandemic and the RIA.

Form I-526 and Form I-829 Processing Data Comparison

At the end of FY2023, USCIS had a backlog of 12,140 pending I-526 and I-526E petitions and 9,989 pending I-829 petitions.

As more rural I-526 and I-526E petitions are filed in FY2024, priority processing under the RIA may result in a significant reduction of the I-526 backlog.

Predicting Future Trends in EB-5 Petition Processing

With further demand on the horizon, the EB-5 industry appears to be entering a new peak period. Both U.S. residents on non-immigrant visas and foreign nationals living abroad can now get U.S. Green Cards and other immigration benefits faster than ever before in the EB-5 program’s 33-year history.

On October 11, 2023, USCIS released a policy update that adjusted the minimum EB-5 investment timeframe to two years from the time of investment. Previously, USCIS required EB-5 funds to remain at risk until the end of an investor’s conditional residency period.

While EB-5 projects are unlikely to be able to repay EB-5 funds in exactly two years, this new policy may allow investors to be repaid within a shorter timeframe than previously.

In addition, USCIS also updated its policy for pre-RIA investors whose regional centers are terminated. If a pre-RIA investor’s regional center is terminated, the investor can now find a new regional center to sponsor their project and move forward with the EB-5 immigration process.

These two significant policy changes may eventually increase I-526 and I-526E filing volumes and approval levels. Foreign nationals may find the EB-5 program more attractive with a faster repayment timeframe.

For the latest information on trends in the EB-5 industry, follow EB5AN’s blog or schedule a free consultation.